Asset Utilization: Key Metrics & Strategies

Asset utilization is the metric that every business should notice to make sure their spending is optimal. Analyzing it is another story.

Asset utilization refers to the assessment of how much the assets in a business are actually being used. For some businesses, knowing asset usage helps them figure out if the money spent on those assets is worth it. For others, it’s more about understanding how much they really need an asset based on how often it’s used, so they can optimize its use or spend more wisely next time, especially for assets with low usage.

All of this is true, and it really depends on what the business is trying to achieve. That is the tricky part. It isn’t just about knowing the asset utilization ratio itself. It’s about figuring out what’s behind that number and what it actually means for the business. And in the end, you will understand what the company needs and how the assets are helping (or not helping) achieve those goals.

Understanding asset utilization

When we talk about asset utilization in IT, we’re basically looking at how much an IT asset is actually being used compared to how much it could be used. There isn’t just one single formula because different IT assets work in different ways. So instead of forcing a universal equation, we measure “usage” based on what makes sense for each type of asset.

IT Asset Utilization Calculation Formula:

There are some common formulas to calculate the usage of IT assets, depending on IT asset types. For example:

- For hardware (laptops, devices, machines):

Asset Utilization = (Usage Hours / Total Available Hours) × 100

- For software licenses:

Asset Utilization = (Active Users / Purchased Licenses) × 100

- For servers or cloud resources:

Asset Utilization = (Actual Resource Use / Total Capacity) × 100

- For rental-style or shared IT assets (like meeting room devices, loaner laptops):

Asset Utilization = (Time In Use / Total Time Available) × 100

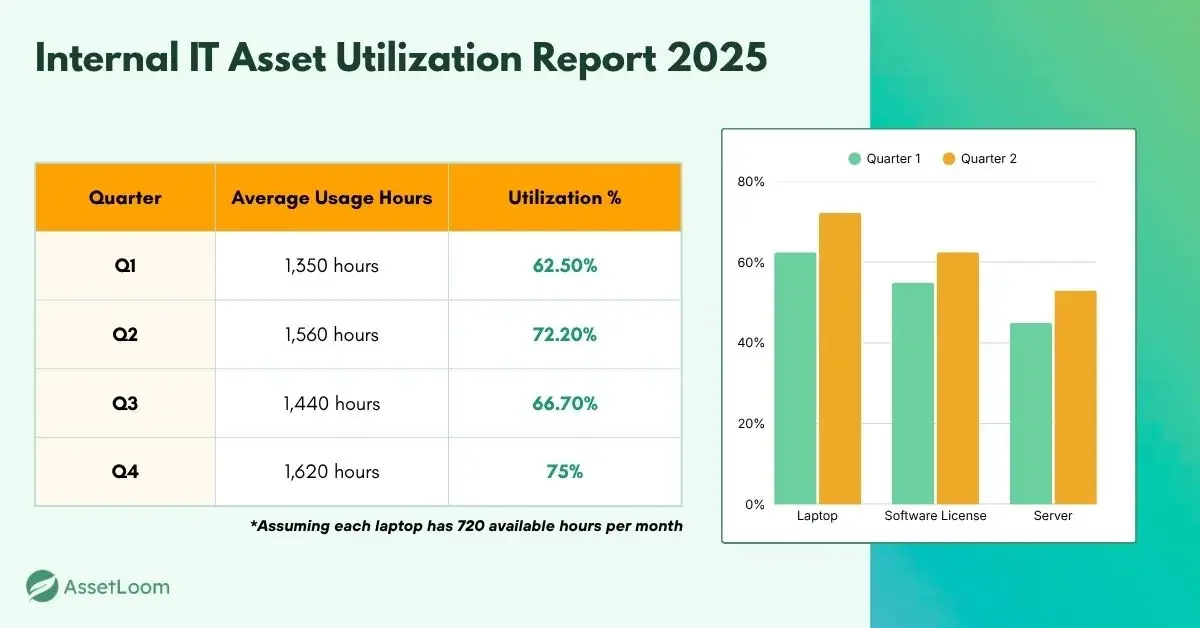

IT Asset Utilization Report Sample

Other Formulas

The formulas for asset utilization aren’t the same for every industry. Each one measures “usage” differently. For example:

In manufacturing, it might be:

Asset Utilization = (Actual Output / Maximum Possible Output) × 100

In rental businesses, it could be:

Asset Utilization = (Hours Rented / Total Available Hours) × 100

But eventually, the idea is the same across all of them: you compare how much the asset is used versus how much it could be used, and that gives you a percentage. The higher the percentage, the more value you're getting from that asset. The exact formula depends on the type of asset and how it creates value.

What is considered “high”, and what is “low”?

Once you calculate the asset utilization ratio, it’s time to figure out what the numbers really mean. A high ratio might indicate that assets are being used efficiently, while a low ratio might point to inefficiency. But how much is considered "high" or "low"?

High Asset Utilization Ratio:

A high asset utilization ratio typically means that assets are being used efficiently and to their full capacity. However, there are limits to this, and the exact threshold can vary.

General Guideline:

- Above 80%: Generally, if your asset utilization ratio is above 80%, it's considered high. It suggests that most of the company's assets are being actively used to generate revenue.

- 90-100%: Ratios this high could indicate that assets are running close to their maximum capacity, which might be great for efficiency but could also lead to overuse and quicker wear and tear. So, a ratio above 90% might be high but risky, depending on the industry.

Example: For a company using heavy machinery, an 85-90% utilization rate could be good, but if it's consistently above 90%, you might be pushing those machines too hard, which could lead to increased maintenance costs.

What if it's High?

If the asset utilization ratio is high, it generally means that the company is efficiently using its assets to generate income. It’s a good sign, especially for companies that rely heavily on physical assets like machinery, buildings, or vehicles. A high ratio suggests that the company is maximizing its resources and getting the most out of its investments.

However, context matters. A very high ratio could also indicate that the company is stretching its assets thin, possibly overworking them, which could lead to maintenance issues or burnout down the road. So, while a high number can be a positive indicator of efficiency, it’s important to look at the overall health of the business.

Low Asset Utilization Ratio:

A low asset utilization ratio typically means that assets are not being used effectively, or the company has more assets than needed for its current operations.

General Guideline:

- Below 50%: If your asset utilization ratio is below 50%, it’s generally considered low. It means the company might have idle assets sitting around, or they’re not being leveraged to their full potential.

- 40% or lower: A ratio this low often signals inefficiency and may indicate that the company is investing too much in assets it doesn't fully use. It might also suggest missed opportunities for revenue generation.

Example: If a business has a large fleet of delivery trucks but they're only being used for a fraction of the day, a low utilization rate (like 40%) could suggest underuse of valuable assets, leading to wasted capital.

What if it's Low?

A low asset utilization ratio means that the company isn’t using its assets effectively. This could be because the company has too many assets for its current operations, or maybe some assets are sitting idle or underused. A low ratio can be a red flag, as it may suggest inefficiency, poor asset management, or missed opportunities for income generation.

That said, a low ratio isn’t always a bad thing. For instance, if a company is in a growth phase or preparing for expansion, it may intentionally have underused assets, waiting for them to be put into service as business ramps up. So, while a low ratio can point to inefficiency, you’ll need to understand the company’s situation to interpret it correctly.

Factors that affect asset utilization

This is where you look for the answer to the why question. The truth is, a lot of things can affect how well a company uses its assets. Some assets get overworked, some barely get touched, and some just sit there for no good reason. Here are the most common factors that shape your asset utilization:

1. Workload distribution

If work isn’t spread out evenly, some assets get used nonstop while others barely do anything. This leads to problems on both ends: overused assets wear out faster, and underused ones become wasted investments.

2. Old or outdated technology

When an asset becomes outdated, people naturally try to avoid using it. Older devices or machines often can’t keep up with new tasks, which leads to underutilization simply because they’re not as efficient or comfortable to use anymore.

3. Poor tracking or missing data

If you don’t know where assets are, who’s using them, or how often they’re being used, it’s almost impossible to measure utilization correctly. Bad data leads to bad decisions, like buying more assets when you actually have enough.

4. Maintenance downtime

Even the best assets need time off. But when maintenance isn’t planned well (or repairs happen unexpectedly), availability drops. Assets sitting in repair mode obviously can’t contribute to utilization.

5. Overprovisioning vs. underprovisioning

Sometimes companies buy too much “just in case.” Other times they don’t buy enough, causing bottlenecks because everyone needs the same resource. Both extremes mess with your asset utilization numbers.

6. Shadow IT and unauthorized usage

People using unapproved tools, software, or devices means those assets aren’t tracked officially. This makes utilization look lower than it actually is—and creates security issues on top of that.

7. Remote vs. onsite work

Ever since remote work became normal, office assets (like monitors, printers, projectors, etc.) can sit unused for long periods. On the flip side, remote workers may end up overusing personal devices or company laptops.

8. Redundant or duplicate assets

Sometimes assets stick around long after they’ve stopped being useful. Maybe a team moved on to different tools, or the equipment was replaced but never removed. These extras take up space but contribute nothing to utilization.

Strategies to optimize asset utilization

So the question is, what to do with the result? This is where you should take appropriate actions to better optimize asset utilization.

1. When Assets Are Underutilized

If your utilization ratio is low, it means you’re not getting enough value out of what you already own. Sometimes assets sit idle because they’re outdated, hidden, forgotten, or simply not needed as much as you thought. Here’s how to fix that:

Reallocate assets smarter

Look at where demand actually is. Maybe one department is drowning while another has unused equipment collecting dust. Moving assets to where they’re needed can instantly improve utilization.

Improve visibility

You can’t optimize what you can’t see. If poor tracking is the issue, start with fixing the basics:

- Keep an updated asset list

- Track who’s using what

- Use barcodes/QR codes/RFID for real-time visibility

Best IT asset management tools can help automate tracking and optimization, saving you time and reducing manual work.

Repurpose or reassign

Some assets might be underutilized simply because their original purpose faded. Instead of letting them sit:

- Give them a new job

- Assign them to another team

- Use them for training, backup, or secondary tasks

Lease or share assets

If you don’t need an asset full-time, consider:

- Leasing it out

- Sharing it across teams

- Putting it in a pooled-resource system

Better to generate value than let it sit unused.

Sell or dispose of dead weight

If an asset is constantly underutilized and there’s no realistic use for it - cut your losses. Sell it, recycle it, or retire it. Freeing up space (and budget) is also a form of optimization.

2. When Assets Are Overutilized

If your utilization ratio is too high (especially above 90%), you might be overworking your assets. High utilization is good… until it starts costing you money in breakdowns, burnout, and downtime.

Do preventive maintenance

Don’t wait for assets to fail. Regular maintenance:

- Lowers repair costs

- Reduces downtime

- Extends asset life

A little care goes a long way.

Balance the workload

If one asset is doing all the work while others are barely used, shift the load. Examples:

- Rotate equipment usage

- Assign tasks evenly

- Organize schedules to avoid bottlenecks

Balancing protects your assets and improves performance.

Upgrade or replace outdated assets

If an asset is overloaded because it’s the only one still capable of performing at the level you need, it might be time to:

- Upgrade to newer models

- Expand capacity

- Invest in more durable equipment

Sometimes the cheapest solution long-term is replacing the problem.

Improve your processes

Sometimes, overutilization has nothing to do with the asset, it’s your workflow. Ask things like:

- “Are we doing extra manual steps?”

- “Is this process still the best way?”

- “Can automation help reduce load?”

Adjust inventory levels

If demand constantly exceeds what your assets can handle, you may be underprovisioned. Solutions:

- Add more units

- Increase backup capacity

- Reevaluate procurement plans

The goal is to meet demand without overworking what you have.

In short…

Underutilization wastes money. Overutilization costs money. The real win comes from finding the balance: using assets enough to get value, but not so much that they break down or burn out. By understanding the factors behind your asset utilization ratio and applying the right strategies, you can keep assets healthy, efficient, and aligned with what your business actually needs.

Subscribe for Expert Tips and Updates

Receive the latest news from AssetLoom, right in your inbox.