What Is Depreciation in the Age of Cloud and SaaS Assets

Discover what depreciation means for cloud and SaaS assets and how modern IT teams track value, cost, and lifecycle in a digital environment.

When people ask what is depreciation, the answer used to be simple. You bought equipment, used it for a few years, and its value dropped as it aged. Every server or laptop had a predictable life cycle and a clear replacement point.

Today, that picture has changed. Most IT environments now rely on cloud platforms and SaaS tools that are rented, not owned. These digital assets do not wear out, but they still lose value when they become outdated, underused, or too costly to maintain.

That is why businesses need to rethink what depreciation means in the cloud era. It is no longer just about physical wear and tear but about understanding how digital assets lose efficiency, usefulness, and return on investment over time.

What Is Depreciation

To understand how the cloud has changed asset management, we first need to be clear on what depreciation actually means.

Depreciation is the process of spreading the cost of a tangible asset over its useful life. When a company buys equipment like a laptop, server, or vehicle, that item starts losing value from the day it is used. Over time, it becomes less efficient, outdated, or worn out. Depreciation records the gradual loss in value, so the company’s books reflect a more realistic picture of what its assets are truly worth.

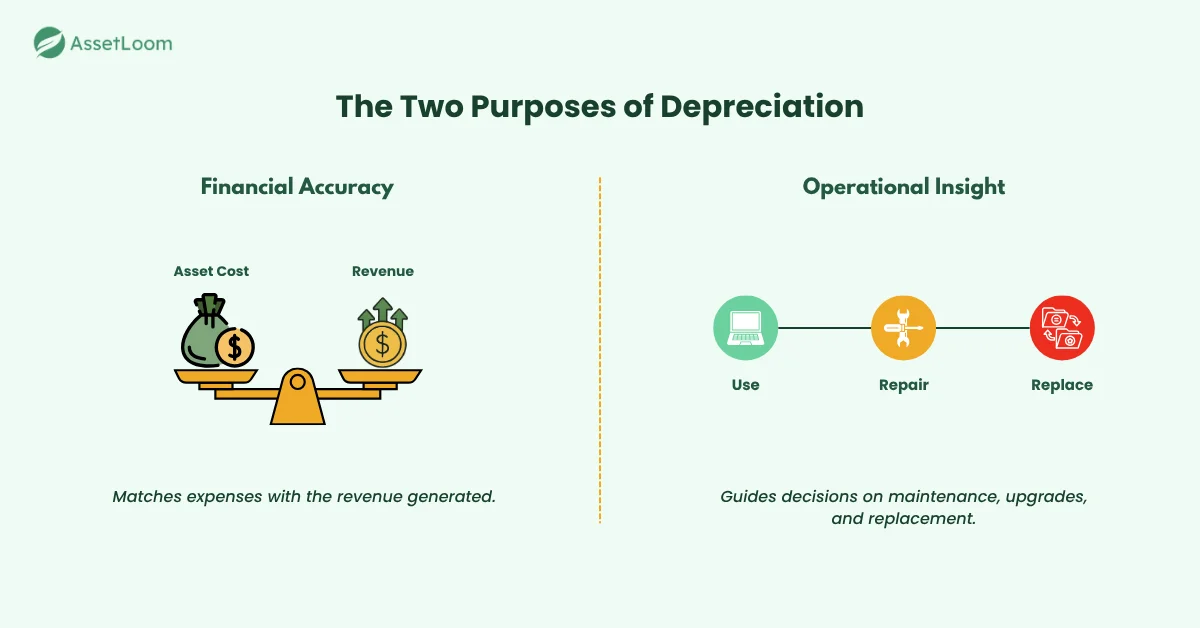

In accounting, depreciation serves two main purposes:

- Financial accuracy: It ensures the expense of an asset is matched with the revenue it helps generate.

- Operational insight: It helps organizations know when to repair, upgrade, or replace assets.

Depreciation does not always mean physical damage. It can also reflect technological obsolescence, when newer equipment or software makes an older one less useful, even if it still works. To stay efficient and financially accurate, organizations must learn to manage depreciating assets effectively. This means tracking not only cost and lifespan, but also performance and replacement timing.

In short, depreciation measures how much of an asset’s value has been used up. It connects finance with reality, showing how time, usage, and innovation affect what a business owns.

Traditional Depreciation: The Accounting Foundation

Now that we understand what depreciation is, it helps to see how it traditionally works in accounting and asset management.

For decades, depreciation was applied mainly to tangible assets, items a company owns and uses over time, such as laptops, servers, office furniture, or vehicles. The goal was simple: spread the asset’s cost across the years it provides value.

How it works

When a company buys equipment, the purchase is recorded as a long-term asset rather than an immediate expense. Each year, a portion of its value is moved from the balance sheet to the income statement as depreciation. This method helps show a more accurate picture of both cost and performance.

For example, if a $5,000 laptop has a useful life of 5 years, the company records $1,000 of depreciation each year. The asset’s book value decreases annually until it reaches zero or its estimated residual value.

Common methods

- Straight-line method: Equal depreciation each year.

- Declining balance method: Higher depreciation in early years, lower later.

- Units of production: Based on actual use or output rather than time.

These approaches work well for assets that can be physically owned, measured, and replaced. They allow organizations to plan upgrades, control maintenance costs, and comply with financial reporting standards.

However, as more businesses shift from owning hardware to using cloud and SaaS services, this traditional model faces a limitation: there is no physical asset to depreciate. The value still changes over time, but in new and less predictable ways.

Read also: How to Compute the Depreciation of Equipment

Cloud and SaaS Assets: The New Depreciation Challenge

In traditional accounting, depreciation applies to physical assets that a company owns. But what happens when the most valuable tools your business uses no longer sit in your office or data center?

That is the reality for most modern organizations. Core systems now run on cloud infrastructure, SaaS applications, and digital subscriptions rented rather than owned. These assets deliver value just like servers or laptops once did, but they operate under a completely different financial model.

The shift from ownership to access

Cloud and SaaS assets do not have a fixed purchase price or a clear useful life. They scale up or down with demand, renew on flexible terms, and can be canceled or replaced at any time. As a result, the concept of depreciation, or value loss over time, does not fit neatly into how these services work.

Instead, their depreciation comes from reduced performance, over-licensing, poor utilization, or changes in business needs. A SaaS license that no one uses is just as wasteful as an unused laptop sitting in storage.

Why traditional depreciation no longer fits

- No ownership: Cloud services are rented, not purchased.

- Variable value: Costs and usage can change from month to month.

- Fast obsolescence: Software updates and new versions appear constantly, making it difficult to define a useful life.

The new goal: managing digital value

Rather than calculating depreciation in the accounting sense, businesses now need to track the ongoing value and utilization of their digital assets.

Questions to ask include:

- How much of our subscription spend is actually used?

- Are renewals aligned with real business needs?

- Which cloud services are no longer delivering a return on investment?

The idea of depreciation still matters. In the cloud and SaaS era, it is less about physical wear and tear and more about ensuring every digital asset continues to deliver value for its cost.

How to Track Depreciation and Value for Cloud and SaaS Assets

If traditional depreciation tracks how physical assets lose value, managing cloud and SaaS assets is about understanding how digital value changes over time. The goal is not only to record costs but to ensure every subscription and service continues to deliver measurable return on investment.

Here is how organizations can take action to track and manage this new form of depreciation effectively.

1. Build a Complete Digital Asset Inventory

Start by identifying every cloud platform, SaaS application, and subscription your organization uses. This includes both centrally purchased tools and shadow IT services that departments may have subscribed to on their own.

Record key details such as:

- Name and purpose of each service

- Owner or responsible department

- License or user count

- Renewal and billing dates

- Monthly and annual cost

- Level of usage or active accounts

Action tip: Conduct a quarterly review to keep this inventory up to date. This prevents overspending on unused tools and ensures visibility across the organization.

2. Define Service Life and Renewal Cycles

In cloud and SaaS environments, assets do not have a fixed lifespan. Their “life” is tied to contract or renewal cycles. Treat each renewal period like a depreciation checkpoint, a moment to evaluate whether the service still provides value.

Ask:

- Has the service met its purpose since the last renewal?

- Are all users still active?

- Is there a more cost-effective alternative?

Action tip: Use your IT asset management tool to set automatic reminders before each renewal. This helps avoid auto-renewals of underused or outdated services.

3. Track Usage, Performance, and Adoption

Depreciation in the digital era is often invisible. It shows up as low usage, redundant features, or underperforming subscriptions.

Track how much of your purchased capacity is actually used. For SaaS, compare licenses purchased versus active users. For cloud infrastructure, measure usage of storage, CPU, and bandwidth.

Action tip: Create utilization benchmarks (for example, at least 80 percent license usage) to flag underused assets early. Regular usage reports will highlight which services deliver value and which quietly drain the budget.

4. Measure Cost Against Value Delivered

Depreciation is not just about cost loss. It is about value erosion. Measure both sides by comparing what you spend with what you gain.

Consider tracking:

- Cost per user or cost per active project

- Productivity impact, such as time saved or collaboration improved

- Performance benefits like uptime or scalability gains

Over time, these metrics reveal which digital assets are increasing in value and which are depreciating due to low adoption or diminishing returns.

Action tip: Build a “value scorecard” for each major service. Combine cost, usage, and business impact to evaluate performance at a glance.

5. Automate Tracking and Reporting

Manual tracking quickly becomes overwhelming. Use an IT asset management system to bring together data from all your cloud and SaaS services.

Automation helps by:

- Sending alerts before renewals and contract expirations

- Detecting unused or duplicate subscriptions

- Generating dashboards that show cost trends, usage, and return on investment

- Simplifying audits and financial reports

Action tip: Integrate your asset management platform with finance and procurement systems. This creates a single source of truth for both operational and financial visibility.

6. Turn Insights Into Action

Once the data is in place, the next step is decision-making. Use your depreciation insights to:

- Negotiate better terms with vendors based on usage patterns

- Eliminate redundant tools or merge overlapping functions

- Plan future budgets more accurately by forecasting real consumption trends

Action tip: Review your digital asset portfolio every six months. Reassess what should be renewed, optimized, or retired to keep your IT ecosystem lean and cost-effective.

The Outcome

By following these steps, organizations transform the idea of depreciation from a static accounting task into a dynamic, data-driven management practice. Tracking digital asset value helps ensure that every subscription, license, and service contributes to business growth rather than silent cost creep.

The focus is no longer on how much assets lose in value but on how effectively your organization maintains and maximizes the value of what it pays for.

Depreciation in Hybrid IT Environments

Most organizations now use a mix of physical and digital assets, from on-premise servers to cloud platforms and SaaS tools. This hybrid setup makes depreciation more complex, since some assets are owned while others are rented.

Physical assets still follow traditional depreciation schedules based on age and wear. Cloud and SaaS assets, however, fluctuate in cost and value depending on usage and renewal cycles.

To manage both effectively, combine financial and operational tracking in one system. Map all assets, apply the right method for each type, and review the total cost of ownership regularly.

When IT and finance teams share data, they can plan upgrades and renewals more strategically. The result is a complete view of asset value, helping the organization make smarter spending and lifecycle decisions.

Compliance and Reporting Implications

Depreciation is not only about tracking value but also about meeting financial reporting and compliance standards. As asset models evolve, so do the rules for how organizations must record and report them.

Under accounting frameworks such as IFRS and GAAP, tangible assets are capitalized and depreciated, while most cloud and SaaS services are treated as operating expenses. However, hybrid or long-term contracts can blur the line, requiring careful evaluation to ensure accurate reporting.

To stay compliant, organizations should:

- Keep clear documentation of all assets, both physical and digital.

- Classify each asset correctly as capital or an operating expense.

- Maintain audit-ready records showing purchase dates, contract terms, and renewal schedules.

- Regularly review accounting treatments as regulations evolve.

A consistent and transparent approach to depreciation reporting builds trust with auditors and stakeholders. It also gives leaders a clearer financial view of how assets contribute to business value over time.

From Depreciation to Digital Value Intelligence

Depreciation today is about more than tracking how equipment loses value. It also means understanding how digital assets, like cloud platforms and SaaS tools, change in worth as your business grows and technology evolves.

Traditional methods still apply to hardware, but cloud and subscription-based assets require a more flexible approach. When finance and IT teams connect cost data with real usage insights, they gain a clearer picture of which assets truly deliver value.

This mindset helps organizations plan budgets with confidence, manage renewals more strategically, and invest in tools that drive long-term performance.

Related Blogs

Subscribe for Expert Tips and Updates

Receive the latest news from AssetLoom, right in your inbox.