How to Compute the Depreciation of Equipment

Discover how to compute the depreciation of equipment using key methods and formulas for better asset management and financial accuracy.

Tracking the depreciation of equipment can feel like a complicated task, but it’s crucial for managing your business’s finances effectively. Whether you're dealing with machinery, computers, or office furniture, failing to properly calculate depreciation can lead to inaccurate financial reports, missed tax deductions, and poor asset management.

In this blog, we’ll show you how to compute the depreciation of equipment using simple methods and formulas. With easy-to-follow examples, you’ll learn how to avoid common pitfalls and ensure you're making the most of your assets, without the headache.

What is Equipment Depreciation?

Equipment depreciation refers to the process of allocating the cost of a depreciating asset over its useful life. As equipment is used, its value decreases due to wear and tear, obsolescence, or aging. In the context of IT asset management (ITAM), this is especially important for assets like computers, servers, and other tech equipment, which lose value more quickly. Depreciation ensures that businesses account for this reduction in value over time.

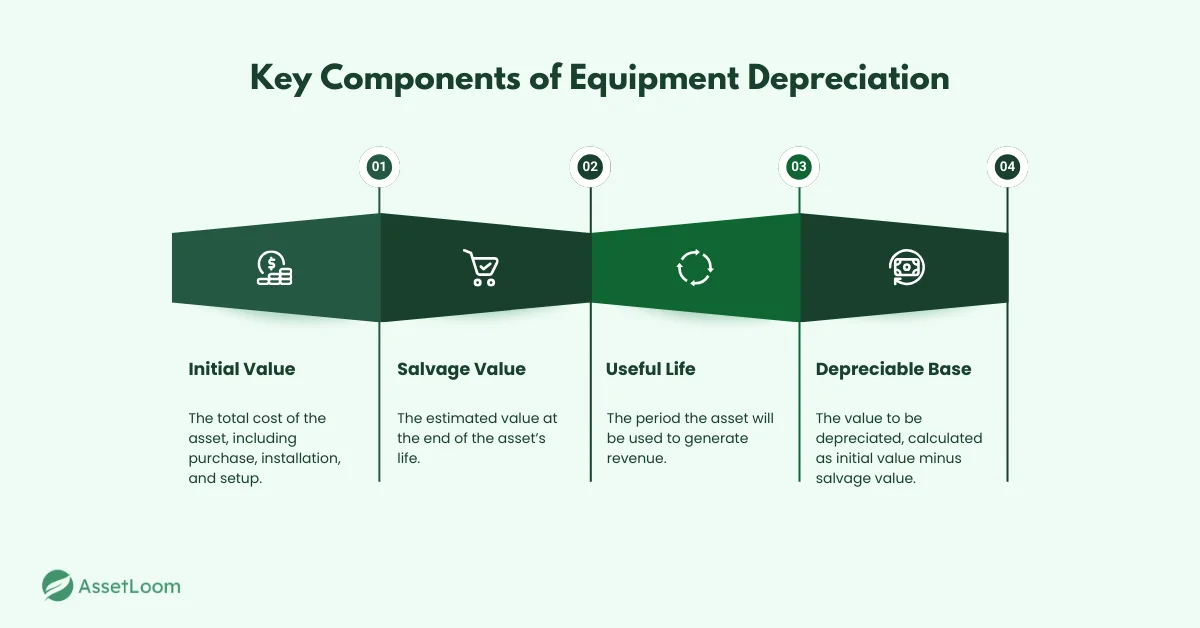

Key Components

- Initial Value: The total cost of acquiring the asset, including purchase price, installation, and setup.

- Salvage Value: The estimated value of the asset at the end of its useful life, or how much it can be sold for when it’s no longer needed.

- Useful Life: The expected duration over which the asset will be used to generate revenue for the business.

- Depreciable Base: This is calculated by subtracting the salvage value from the initial value. It’s the amount that will be depreciated over the asset’s useful life.

Purpose

The goal of depreciation is to match the cost of using the asset with the revenue it helps generate. By doing this, businesses ensure accurate financial reporting and can take advantage of tax benefits, making sure that their books reflect the true value of their depreciating assets.

Depreciation Methods and Formulas

There are several methods used to calculate the depreciation of equipment, each suited for different types of assets and business needs. Below, we will explore the most common depreciation methods along with the formulas and simple examples to help illustrate how they work.

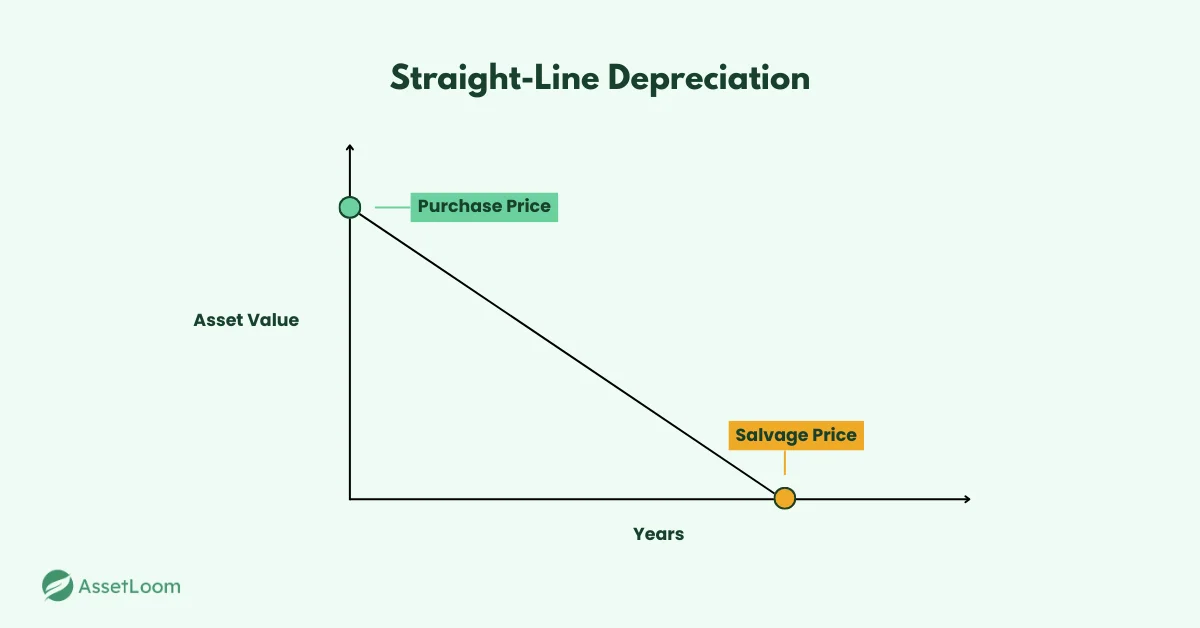

1. Straight-Line Depreciation

Straight-line depreciation is the simplest and most widely used method. It assumes that the asset will lose value evenly over its useful life. This method is ideal for assets that provide consistent value throughout their lifespan and don't experience significant wear and tear in specific periods. It's a predictable, easy-to-manage method often favored by businesses for its simplicity and reliability.

Formula:

Annual Depreciation = (Initial Value – Salvage Value) ÷ Useful Life

Example:

Let’s say you purchase a piece of equipment for $10,000. The expected salvage value is $1,000, and the useful life is 5 years. The annual depreciation is calculated as:

Annual Depreciation = (10,000 – 1,000) ÷ 5 = 1,800

So, the equipment will depreciate by $1,800 per year for the next 5 years.

Use Case:

Ideal for assets with consistent usage over time, such as office furniture, buildings, or computers, where wear and tear is spread evenly throughout their useful life.

2. Declining Balance Depreciation

Declining balance depreciation is an accelerated depreciation method. It assumes that an asset loses value more quickly in its earlier years, which makes it ideal for assets that experience higher wear and tear or obsolescence early in their life cycle. This method allows for larger depreciation expenses in the first few years, reflecting the more significant loss of value during the initial period of use.

Formula:

Annual Depreciation = Book Value at Beginning of Year × Depreciation Rate

Example:

Let’s say you purchase a vehicle for $20,000 with a depreciation rate of 40%. In the first year, the depreciation would be calculated as:

Annual Depreciation = 20,000 × 40% = 8,000

So, the vehicle will depreciate by $8,000 in the first year. The book value after the first year will be:

Book Value = 20,000 – 8,000 = 12,000

In the second year, the depreciation will be calculated on the new book value of $12,000:

Annual Depreciation = 12,000 × 40% = 4,800

Use Case:

Best suited for assets like vehicles, machinery, and technology that depreciate faster in the early years due to high initial usage or rapid obsolescence, such as in the case of tech devices or high-mileage vehicles.

3. Units of Production Depreciation

The units of production method ties depreciation directly to the asset’s usage or production output. Instead of spreading the cost evenly over time, depreciation is based on how much the asset is used or how many units it produces. This method is ideal for machinery or equipment where wear and tear are closely related to its operational use, such as manufacturing equipment or vehicles with variable usage.

Formula:

Annual Depreciation = (Initial Value – Salvage Value) ÷ Total Estimated Production × Units Produced in Period

Example:

Let’s say you purchase a machine for $50,000, with an estimated salvage value of $5,000, and it is expected to produce 100,000 units over its life. In the first year, the machine produces 20,000 units. The depreciation per unit is:

Depreciation per Unit = (50,000 – 5,000) ÷ 100,000 = 0.45

Then, the depreciation for the first year is:

Annual Depreciation = 0.45 × 20,000 = 9,000

So, the machine will depreciate by $9,000 in the first year, based on its usage.

Use Case:

Ideal for assets like manufacturing equipment or vehicles that experience varying levels of use, where depreciation should be tied to actual production or operating hours.

4. Sum-of-the-Years'-Digits (SYD) Depreciation

The Sum-of-the-Years'-Digits (SYD) method is an accelerated depreciation approach that allows for higher depreciation in the early years of an asset’s useful life. The logic behind this method is that an asset provides more value in its initial years and should lose more value upfront. SYD is ideal for assets that lose significant value quickly but not as rapidly as under the declining balance method.

Formula:

Annual Depreciation = (Remaining Life / Sum of the Years' Digits) × (Initial Value – Salvage Value)

Sum of the Years' Digits Formula:

Sum of the Years' Digits = n(n + 1) / 2

Where n is the useful life of the asset in years.

Example:

Let’s say you purchase an asset for $15,000 with a salvage value of $2,000 and an expected useful life of 5 years. The sum of the years' digits is:

Sum of the Years' Digits = 5(5 + 1) / 2 = 15

The depreciation for the first year, where the remaining life is 5 years, is calculated as:

Annual Depreciation = (5 / 15) × (15,000 – 2,000) = (5 / 15) × 13,000 = 4,333.33

So, the asset will depreciate by $4,333.33 in the first year.

Use Case:

Best for assets that lose significant value in the early years of use, but not as quickly as with the declining balance method. It’s commonly used for vehicles, machinery, or equipment that provides more utility upfront.

Choosing the Right Depreciation Method

Choosing the right method for depreciating your assets depends on several factors. Here's what to consider:

Factors to Think About:

- Asset Type: Different types of assets (like machinery, vehicles, or technology) lose value in different ways, so each may need a different depreciation method.

- Usage Patterns: Does the equipment experience heavy use in the early years? If so, accelerated methods like declining balance depreciation might be better.

- Financial Goals: Some methods, like accelerated depreciation, give bigger tax benefits in the early years by lowering taxable income faster, which can help with cash flow.

- Industry Standards: Many industries have common depreciation practices, so it's good to be aware of what's typical for your sector.

Tax and Financial Impact:

The depreciation method you choose can affect your tax deductions. For example, accelerated depreciation allows you to claim larger deductions early on, lowering your tax burden right away.

Conclusion

Figuring out how to compute the depreciation of equipment is more than just an accounting task. It’s a key part of managing your business’s assets and keeping your financials on track. Whether you go with the straightforward straight-line method or opt for the faster write-offs of declining balance depreciation, the right method depends on the type of asset and how it’s used.

By understanding depreciation, you can make smarter decisions about when to replace or maintain assets, save on taxes, and keep your business running smoothly. With the information from this guide, you’re ready to confidently manage your equipment and make the most of your assets.

Related Blogs

Subscribe for Expert Tips and Updates

Receive the latest news from AssetLoom, right in your inbox.