How to Track and Manage Depreciating Assets?

What is a depreciating asset, common examples, and how ITAM with AssetLoom helps track and manage depreciation effectively.

Have you ever bought something expensive, only to realize a few years later it’s worth much less than what you paid? Maybe it was a car that lost value the moment you drove it home or a laptop that feels outdated after just a couple of upgrades. This drop in value over time is something we all deal with, and it has a name — depreciation.

Understanding how depreciation works can help you make better decisions when buying, using, and replacing the things you own. It’s just as important for individuals as it is for businesses, especially when planning budgets and managing assets.

What is a Depreciating Asset?

A depreciating asset is something you own that loses value over time. This could be because it’s getting older, wearing out from use, or simply becoming less useful compared to newer options.

Think about a smartphone. The day you buy it, it’s worth its full price. Two years later, it’s slower, the battery doesn’t last as long, and newer models have better features. If you tried to sell it, you’d get much less than you paid. That’s depreciation in action.

Not all assets lose value. Some things, such as certain pieces of art or land in a desirable location, can increase in value. These are called appreciating assets. But most items we use in daily life — especially those with a limited lifespan — will eventually be worth less than when we got them.

In IT Asset Management (ITAM), tracking depreciating assets is an important part of understanding an asset’s current worth, planning replacements, and managing budgets effectively.

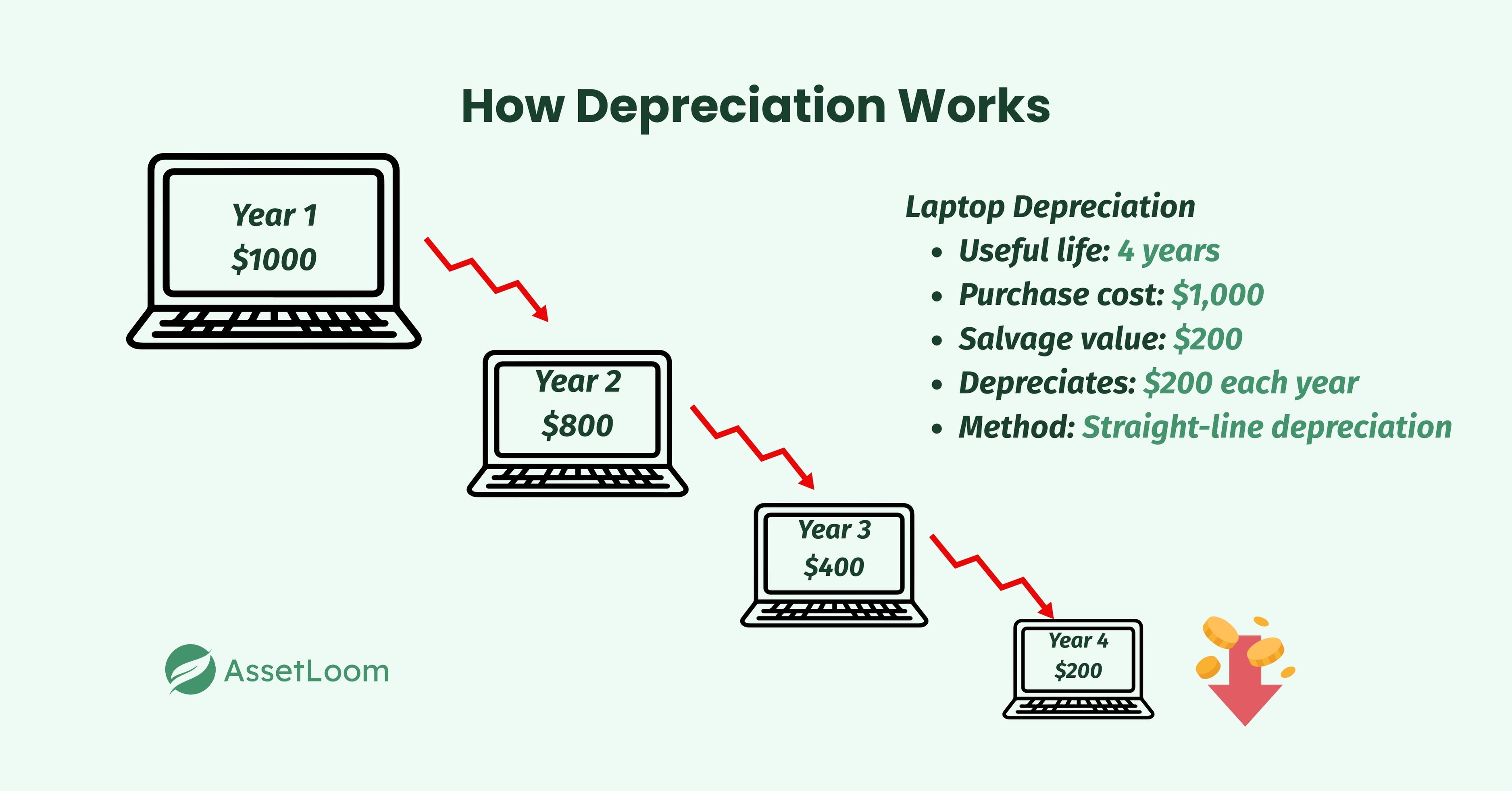

How Depreciation Works

Depreciation is simply the gradual loss of value in an asset over time. It happens for a few common reasons:

- Wear and tear: The more you use something, the more it shows signs of aging. Cars rack up miles, machines wear down, and furniture gets scuffed.

- Aging: Even if you don’t use it much, time alone can reduce value. Materials weaken, designs become outdated, and technology moves on.

- Obsolescence: Newer, better versions come out, making the old ones less desirable. A computer from five years ago might still work, but it probably can’t keep up with modern software.

In accounting, there are different ways to measure depreciation. Some methods spread the loss of value evenly over an asset’s life, while others reduce its value more in the early years and less later on. But at its core, depreciation is about recognizing that most things won’t hold their original value forever.

Types of Depreciating Assets

Depreciating assets come in many forms, but they usually fall into two main categories: tangible and intangible.

1. Tangible Assets

These are physical items you can touch and use. Over time, they wear out or become outdated. Examples include:

- Vehicles: cars, trucks, vans, or company vehicles lose value with mileage and age.

- Machinery and equipment: factory machines, tools, or construction equipment wear down from use.

- Electronics: computers, smartphones, and tablets become slower or incompatible with new technology.

2. Intangible Assets

These are non-physical assets that still lose value as they get closer to the end of their useful life. Examples include:

- Patents: have a set lifespan before they expire.

- Software licenses: may need renewing or replacing as technology changes.

- Copyrights: expire after a certain number of years, depending on the law.

Both tangible and intangible assets can lose value at varying rates, depending on how they are utilized and the market environment surrounding them.

Common Examples of Depreciating Assets

While almost everything we use wears out or becomes outdated at some point, some assets are more well-known for losing value over time. Here are a few examples you might recognize:

- Office equipment – Printers, desks, chairs, and other furniture gradually lose value as they age or show wear.

- IT hardware – Laptops, servers, and monitors become slower and may no longer support the latest software.

- Company vehicles – Cars, vans, and trucks lose value quickly due to mileage, wear, and newer models being released.

- Machinery – Tools and industrial machines wear down after years of operation.

- Leasehold improvements – Renovations or upgrades made to a rented space lose value over the lease term.

In everyday life, you’ve probably seen this happen — that brand-new piece of tech you bought last year might already be worth much less if you tried to sell it today.

Why Understanding Depreciation Matters

Knowing how depreciation works isn’t just for accountants. It can help you make better decisions in both personal and business life. Here’s why it’s important:

- Planning for replacement – Assets don’t last forever. Knowing when something will need to be replaced helps you budget ahead of time.

- Better financial decisions – If you understand how quickly an item loses value, you can decide whether buying new, used, or leasing makes more sense.

- Tax benefits – In many places, depreciation can be counted as an expense for businesses, reducing taxable income.

- Avoiding surprises – If you’re aware of an asset’s declining value, you won’t be caught off guard when it needs repairs or replacement.

In short, keeping depreciation in mind means fewer financial surprises and smarter long-term planning.

How to Track and Manage Depreciating Assets

Keeping track of assets and their depreciation isn’t just about numbers on a spreadsheet — it’s about making sure you’re prepared for repairs, replacements, and budget planning. Whether you’re managing personal belongings or running a business, a good system can save you time and money.

1. Create a detailed asset register

List every asset you own, along with key details like:

- Purchase date

- Purchase price

- Expected lifespan

- Current condition

- Serial or identification numbers (for electronics or machinery) This makes it easy to see at a glance what you have, how old it is, and how much value it may have lost.

2. Track depreciation regularly

Don’t just record the purchase and forget about it. Review your asset list once or twice a year to update values. This helps you know if it’s worth repairing something or replacing it.

3. Schedule regular maintenance

Servicing a vehicle, cleaning IT equipment, or updating software can slow down depreciation. Preventative care often costs less than major repairs or replacements.

4. Use asset tracking tools

While a spreadsheet works for small lists, businesses often benefit from it asset management software. These tools can:

- Automatically calculate depreciation based on set rules

- Send reminders for maintenance or warranty expiry

- Keep all asset records in one place for easy access

5. Plan for replacements in advance

If you know a laptop lasts about four years or a delivery van about seven, start budgeting for its replacement early. That way, you avoid large, unexpected expenses.

6. Keep receipts and documentation

Receipts, warranties, and service records not only help with depreciation tracking but also come in handy if you sell the asset or need to make an insurance claim.

By combining good record-keeping with regular reviews, you can make smarter decisions about when to repair, upgrade, or replace your assets — and avoid being caught off guard by sudden costs.

How AssetLoom Can Help

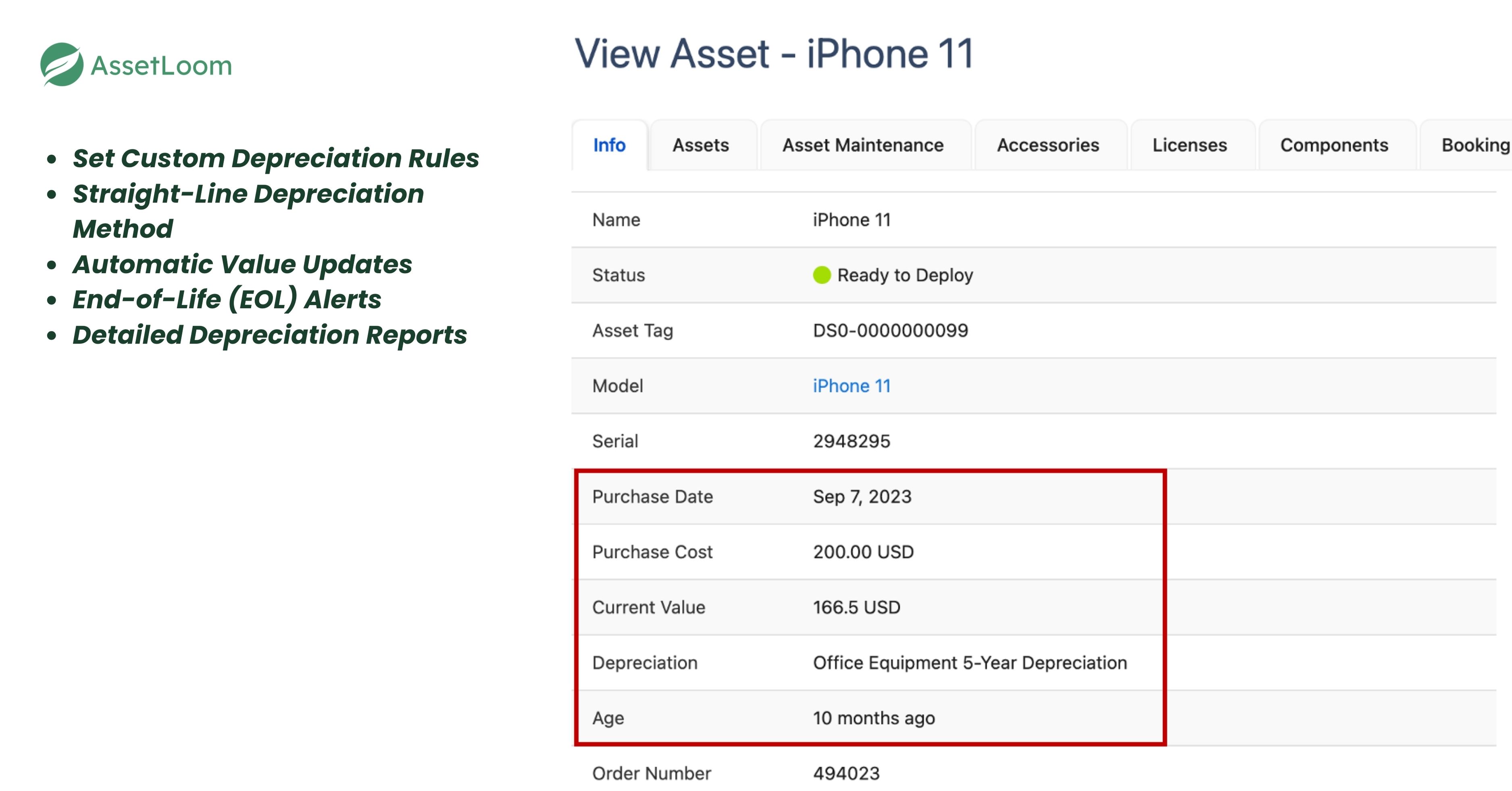

AssetLoom takes the hassle out of tracking asset depreciation by letting you set clear rules, automating the calculations, and giving you timely alerts for better planning.

Set Custom Depreciation Rules

In AssetLoom, you can define exactly how each type of asset should lose value over time. These rules include:

- Depreciation period – How long the asset will be depreciated, in months. For example, 15 months for a laptop or 60 months for office furniture.

- Minimum value (floor value) – The lowest value an asset can reach after depreciation, such as $100.

Once you set a rule, AssetLoom automatically applies it to all assets in the chosen category. This means you don’t have to manually calculate depreciation for each item — the system does it for you, consistently and accurately.

Straight-Line Depreciation Method

AssetLoom uses the straight-line method to calculate depreciation. This approach spreads the asset’s loss of value evenly over its entire depreciation period.

The calculation is based on two main details you enter when adding the asset:

- Purchase cost – The amount paid for the asset.

- Purchase date – The date the asset was acquired.

With these inputs, AssetLoom works out the same depreciation amount for each day until the asset reaches its minimum value. This method is simple, predictable, and widely used for business asset tracking.

Automatic Value Updates

Once a depreciation rule is in place, AssetLoom automatically updates each asset’s value every day.

- The system applies your depreciation settings to reduce the asset’s value steadily over time.

- If the calculated value drops below the minimum value you’ve set, AssetLoom keeps it at that floor value instead of letting it go lower.

This means you always have an accurate, up-to-date record of what each asset is worth, without needing to run manual calculations or update spreadsheets.

End-of-Life (EOL) Alerts

AssetLoom keeps track of each asset’s depreciation timeline and expected lifespan. When an asset is getting close to the end of its depreciation period or useful life, the system sends you an alert.

These notifications give your finance team enough time to:

- Plan for replacements or upgrades.

- Allocate budget in advance.

- Avoid unexpected costs from sudden breakdowns or urgent purchases.

With these alerts, you can move from reactive spending to proactive planning.

Detailed Depreciation Reports

AssetLoom can generate clear reports that show exactly how your assets are losing value over time. These reports can include:

- The current value of each asset.

- How much value has been lost so far.

- Which assets are approaching their minimum value or end of life.

Finance teams can use these reports to:

- Forecast upcoming replacement costs.

- Plan budgets with accurate data.

- Identify assets that may need early replacement or extra maintenance.

Having this information in one place makes it easier to make informed decisions without digging through scattered records or spreadsheets.

Conclusion

Depreciation is a fact of owning assets, but it doesn’t have to be a surprise. By understanding how and when assets lose value, you can plan ahead, avoid sudden costs, and make smarter financial decisions. Whether you track manually or use a tool like AssetLoom, the key is staying informed and proactive.

Related Blogs

Subscribe for Expert Tips and Updates

Receive the latest news from AssetLoom. right in your inbox