Is Software Always a Fixed Asset? What Businesses Need to Know

Is software always a fixed asset? The short answer is no. This blog explains how to classify it correctly and why it matters for your business.

Buying software for your business seems simple, until it’s time to figure out how to classify it in your financial records. Is it a fixed asset? An intangible asset? Or just another operating expense?

If you’ve ever found yourself asking these questions, you’re not alone. As more companies invest in digital tools, the line between software as a product and software as a service has gotten a little blurry. And the way you classify that software matters a lot more than you might think.

Before we dive into the specifics of software, it’s helpful to understand what a fixed asset actually is. In short, fixed assets are long-term resources your business uses to operate and generate revenue. We’ve already covered this topic in detail, so if you want a full breakdown, check out our blog on What Is a Fixed Asset?

Now let’s look at how software fits into this picture.

Can Software Be a Fixed Asset?

Yes, software can be a fixed asset, but not always. It depends on how your business uses it, how much it costs, how long you’ll use it, and whether you actually own it.

Traditionally, fixed assets are physical items like computers or vehicles. Software is different because it's intangible. You can’t touch it, but it can still meet the same criteria as other fixed assets.

If your business purchases software for long-term use, such as a custom-built system or an enterprise-level tool like an ERP or CRM platform, it often qualifies as a fixed asset. The key is that it must be used to support your operations over multiple years, not just a one-time or short-term solution.

In these cases, the cost of the software can be capitalized and tracked just like other fixed assets. Over time, it will be amortized instead of depreciated (since it’s intangible), but the concept is the same. The value is spread out across its useful life.

So while software may not be a physical object, in many situations, it fits the definition of a fixed asset, especially when it plays a long-term role in helping your business run.

When Is Software Not a Fixed Asset?

Not all software qualifies as a fixed asset. In fact, many types of software are considered operating expenses instead. The difference comes down to how the software is used, how long it will be in use, and how it's paid for.

One common example is subscription-based software, also known as SaaS (Software as a Service). These tools are typically billed monthly or annually and can be canceled or changed at any time. Since your business doesn’t actually own the software and it might not be used long term, it's usually treated as a regular expense.

Short-term licenses or temporary software used for a specific project also don’t count as fixed assets. These are consumed quickly, don’t provide lasting value, and aren’t owned outright, so they’re recorded as operating costs.

In some cases, software might even seem important to your operations but still not meet the criteria. If it doesn’t have a clear long-term benefit, or if its cost is too low to be capitalized, it won’t qualify as a fixed asset.

When in doubt, the key question to ask is this: Will this software provide measurable value to my business over multiple years, and do we own it outright? If the answer is no, it's likely not a fixed asset.

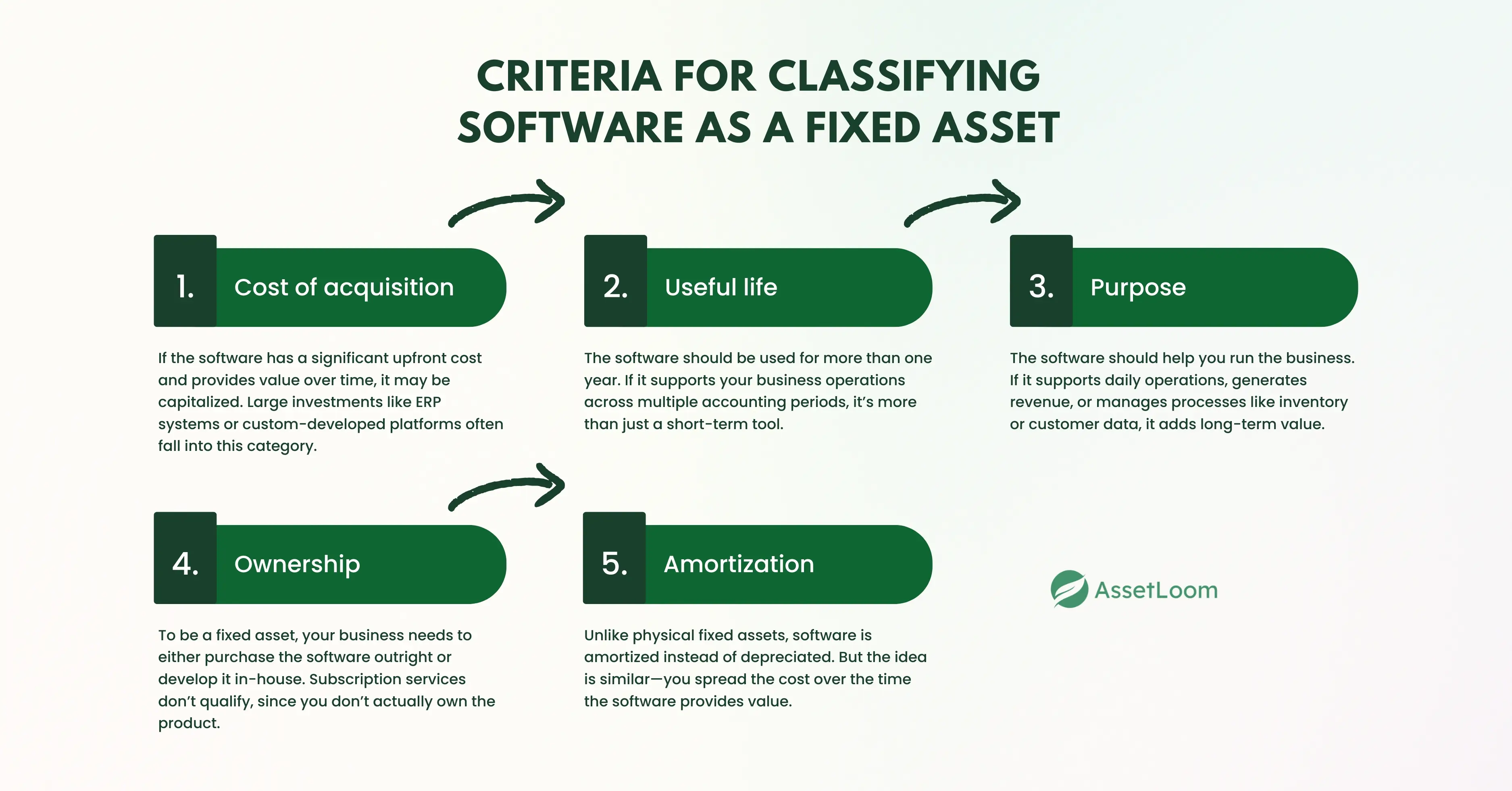

Criteria for Classifying Software as a Fixed Asset

So, how do you know if a piece of software should be treated as a fixed asset or just an expense? The answer comes down to a few key factors. If your software meets most of these, it’s likely a good candidate for fixed asset classification.

Cost of acquisition

One of the first things to consider is how much the software costs. High-cost software that's expected to support your business over time is usually treated as a fixed asset. This includes things like enterprise-level tools, custom-built applications, or one-time license purchases that come with a long-term benefit.

For example, if your company spends $20,000 on a project management system that will be used for the next five years, that’s not just a regular expense. It’s an investment that should be capitalized and tracked as a fixed asset.

On the other hand, low-cost software that’s paid monthly or used temporarily doesn’t meet this threshold. It’s typically better to treat these kinds of tools as operational expenses.

If your finance team uses a capitalization policy with a minimum cost threshold (like $2,500 or $5,000), that’s also a good rule of thumb for deciding whether a software purchase belongs on your fixed asset list.

Useful life

Another key factor in classifying software as a fixed asset is how long you plan to use it. If the software is expected to provide value to your business for more than one year, it usually meets the “useful life” requirement for a fixed asset.

Think about tools like accounting software, ERP systems, or industry-specific applications. These aren't things you use once and forget about. They support your business operations day after day, often for several years.

In contrast, if you're using software for a short-term project or only planning to keep it for a few months, it likely doesn’t qualify as a fixed asset. The same goes for trial versions or tools with no clear long-term use.

The longer the software is expected to be in service, the stronger the case for treating it as a fixed asset. Just like with physical equipment, the useful life helps determine how the cost should be spread out over time.

Purpose

The way your business uses the software plays a big role in how it should be classified. If the software supports your day-to-day operations, helps deliver services, or contributes to generating revenue, it’s likely serving a long-term business purpose. In that case, it could be considered a fixed asset.

For example, software that manages inventory, processes transactions, tracks customers, or handles logistics is clearly tied to your core business activities. It’s not just useful—it’s essential.

On the other hand, if the software is used for something temporary, experimental, or not directly tied to business functions, it’s more likely to be considered an expense. The same applies to tools used only by a small team for limited tasks.

The bottom line is this: if the software is helping your business run more efficiently or stay competitive over time, its purpose supports fixed asset classification.

Ownership

To classify software as a fixed asset, your business needs to own it—not just rent or subscribe to it. Ownership means you either purchased the software outright or developed it in-house, and you have full rights to use it over its expected life.

This includes one-time license purchases or custom software built specifically for your organization. In these cases, you have control over the software, and it delivers long-term value, making it a strong candidate for fixed asset treatment.

However, if you're using subscription-based software (like most SaaS platforms), you don’t technically own the software—you’re just paying to access it. Even if you use it every day, it’s considered an operating expense because you can cancel or switch providers at any time.

In short, ownership adds long-term control and stability, which are key traits of a fixed asset.

Amortization

Once software is classified as a fixed asset, it doesn’t just sit on your balance sheet at full cost forever. Instead, its value is gradually reduced over time through a process called amortization.

Amortization works a lot like depreciation, but it’s used for intangible assets like software rather than physical ones. It helps spread out the cost of the software over its useful life, matching the expense to the periods in which the software is actually used.

For example, if you purchase a $10,000 piece of software that your business will use for five years, you might amortize $2,000 each year. This gives a more accurate picture of your expenses and helps avoid a big hit to your books in the year you make the purchase.

If the software is a subscription or short-term license, it won’t be amortized. It’s simply expensed as you pay for it.

Understanding amortization helps ensure your financial reports reflect the true value of your software over time.

Tangible vs. Intangible – Why Software Can Be Both

At first, it seems simple. Software is intangible, right? You can’t hold it, touch it, or store it on a shelf. So how could it ever be treated like a tangible asset?

Here’s where it gets interesting. In accounting, the term “tangible” doesn’t always mean physical. It can also mean measurable. If something has a clear cost, provides long-term value, and can be tracked on your balance sheet, it may be treated similarly to a tangible asset—even if you can’t physically see it.

That’s exactly the case with some software. If your business purchases or develops software that has a high cost, a multi-year useful life, and supports your operations, it can be treated as a tangible fixed asset for accounting purposes.

This is different from things like brand value or intellectual property, which are harder to measure and often fall under the category of intangible assets that aren’t fixed. With software, there’s usually a specific price tag and a clear purpose, which makes it easier to classify and manage like a tangible asset.

So while software remains intangible in the literal sense, its role in your business and its value on your books can give it a tangible presence in your asset management strategy.

Common Software Types and How They're Classified

Not all software is created equal, and how you classify it often depends on how it’s used, how it's paid for, and how long it will serve your business. Let’s look at a few common types of software and how they’re typically handled in accounting.

Enterprise Software

This includes tools like ERP systems, CRM platforms, and accounting software. These are often purchased with a large upfront cost and used for several years. Since they support core operations and have a long-term impact, they are usually classified as fixed assets and amortized over time.

Custom-Developed Software

If your company builds its own software for internal use, it can often be treated as a fixed asset. This includes everything from custom apps to in-house tools that automate operations or manage workflows. As long as the software is expected to be used for more than one year, it likely qualifies.

SaaS and Subscription Software

Software-as-a-Service (SaaS) products are generally not considered fixed assets. Since you don’t own the software and typically pay on a monthly or annual basis, they’re classified as operating expenses. Even if they’re used long term, their subscription nature means they don’t meet the ownership or capitalization criteria.

Utility or Operational Tools

Think of smaller software products like design tools, communication apps, or team productivity platforms. These may or may not qualify as fixed assets depending on the cost, ownership, and expected lifespan. If they’re low-cost or used for a short period, they’re usually expensed.

Managing Software Assets Effectively

Once you’ve figured out how to classify your software, the next step is keeping track of it. Software might not take up physical space like a desk or a laptop, but it still needs to be managed carefully, especially if it’s used across teams or locations.

Start by making sure every software asset management is documented. This includes purchase details, license terms, renewal dates, user access, and how it’s being used. Whether the software is a fixed asset or not, having all this information in one place helps reduce confusion and avoid overspending on unused tools.

It’s also important to track who’s using what. If licenses are shared or reassigned, keeping a record ensures you stay compliant with usage limits and avoid surprise charges.

For businesses managing a growing list of tools, using an IT asset management platform like AssetLoom can make this process a lot easier. AssetLoom helps you organize your IT assets, track usage, manage bookings, and keep everything visible in one place. That kind of clarity is key to making smarter software decisions.

Conclusion

So, is software always a fixed asset? The short answer is no. It depends on how the software is used, how much it costs, how long it’s expected to last, and whether your business owns it.

Understanding these details helps you classify software correctly, stay compliant, plan your budget, and maintain more accurate financial records. And while not every software product ends up on your fixed asset list, every software decision should be intentional. When your tools are well-organized and properly tracked, you set your business up for smarter decisions, fewer surprises, and better long-term value.

Related Blogs

Subscribe for Expert Tips and Updates

Receive the latest news from AssetLoom, right in your inbox.