What Is Fixed Asset Tracking? A Simple Breakdown

What fixed asset tracking means, how it works, and why it’s essential for managing equipment, vehicles, and other long-term assets.

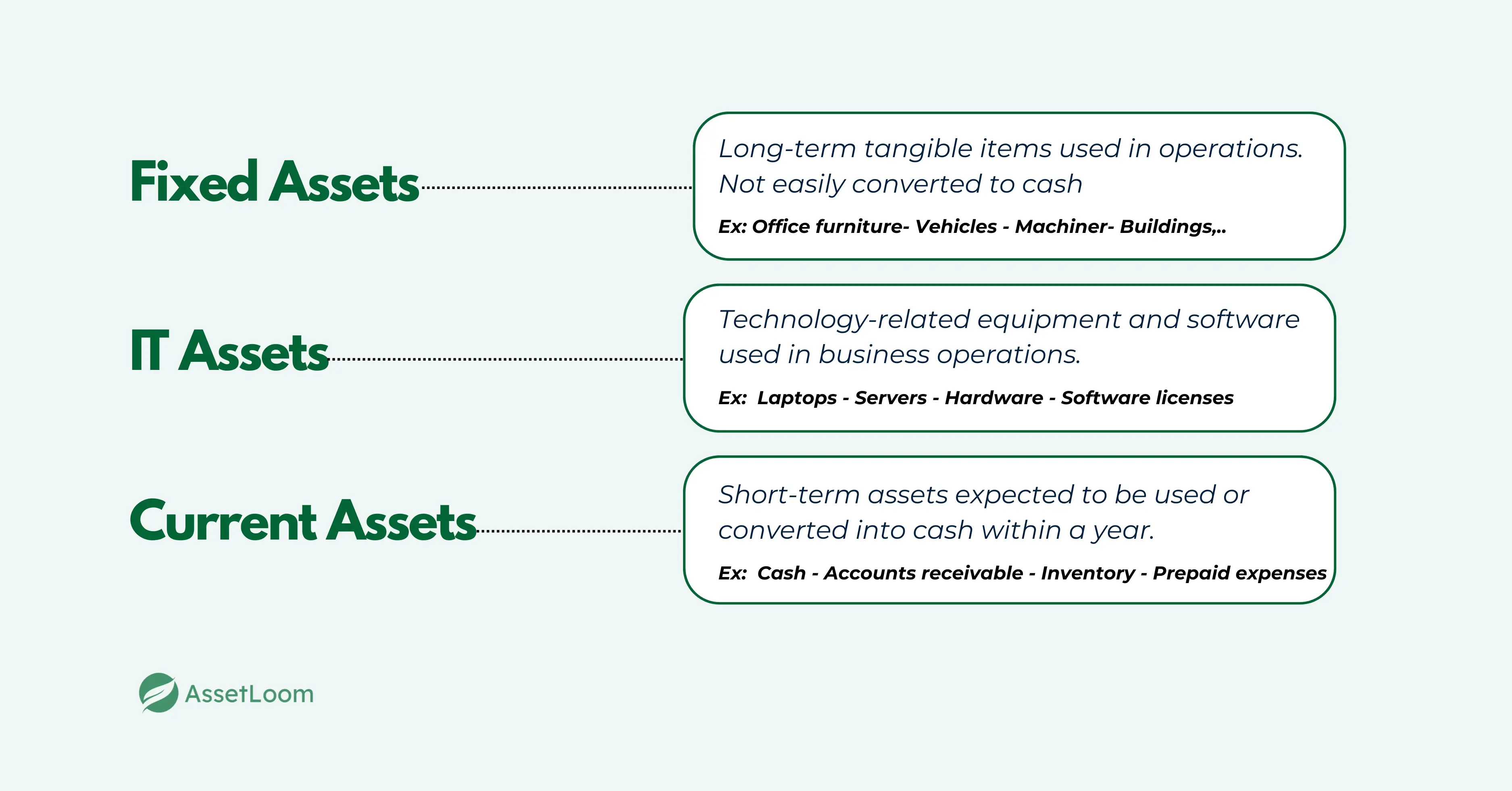

Not all assets are the same. Some are used up quickly, like office supplies or inventory. Others stay in service for years and support daily operations without being sold or consumed.

These longer-lasting items are called fixed assets. Think of computers, machinery, furniture, or vehicles. Unlike current assets, which are used or sold in the short term, fixed assets remain part of the organization for a longer period.

Because they hold long-term value and stay in use, fixed assets need to be tracked differently. It’s not just about knowing what was purchased. It’s also about where it is, who is using it, and when it might need maintenance or replacement.

What Are Fixed Assets?

Fixed assets are long-term physical resources that a company uses to run its operations. Unlike inventory or office supplies, these items are not meant to be sold or used up quickly. They are expected to last more than a year and are critical for delivering products, services, or administrative functions.

You may also hear fixed assets referred to as Property, Plant, and Equipment (PP&E). Common examples include:

- Buildings and office space

- Machinery and production equipment

- Company-owned vehicles

- Computers and other IT hardware

- Furniture and fixtures

- Land

What makes fixed assets different from current assets like cash or inventory is their longevity and purpose. They are not held for resale. Instead, they are used to support business activities over time.

From an accounting perspective, fixed assets are listed as noncurrent assets on the balance sheet. Most are depreciated over their useful life to reflect wear and tear, which helps match their cost to the income they help generate. Land is a key exception—it does not depreciate.

Fixed assets also play a vital role in financial reporting and operational planning. They represent the infrastructure that allows a company to grow, scale, and serve its customers. Without them, day-to-day functions would be disrupted.

In short, fixed assets are durable, high-value tools that keep the business running. Tracking them properly is essential for both operational control and long-term financial accuracy.

Comparison Table: Fixed Assets vs IT Assets vs Normal Assets

| Category | Fixed Assets | IT Assets | Normal (Current) Assets |

|---|---|---|---|

| Definition | Long-term tangible assets used to support operations | Hardware and software used for IT functions | Short-term assets expected to be used or sold soon |

| Examples | Buildings, vehicles, machinery, land, furniture | Laptops, servers, monitors, networking gear, licensed apps | Cash, office supplies, inventory, accounts receivable |

| Expected Lifespan | More than one year | Varies; most are also long-term (1–5 years) | Less than one year |

| Accounting Category | Noncurrent assets (PP&E) | Can be part of fixed assets or tracked separately | Current assets |

| Tracked for Depreciation | Yes (except land) | Yes, if capitalized (hardware); no for expensed software | No |

| Use in Operations | Infrastructure and core operations | Support business through technology | Daily consumption or turnover |

| Convertibility to Cash | Not easily converted | Not easily converted | Easily converted or consumed |

| Tracking Tools Needed | Asset management systems | IT asset management tools (ITAM, CMDB, etc.) | Inventory systems or accounting software |

Note:

- Some IT assets are also considered fixed assets if they meet capitalization thresholds (e.g., a $2,000 server).

- "Normal assets" refers to current assets, which are short-term and liquid by nature.

Example: A laptop can be both an IT asset and a fixed asset depending on how a company classifies it.

- As an IT asset, it’s part of the technology equipment used for daily business operations—like computers, servers, software, and networking gear.

- As a fixed asset, it qualifies when its cost exceeds the company’s capitalization threshold (for example, $2,000 or more). If it meets that threshold, the laptop is recorded on the balance sheet, depreciated over time, and tracked as a fixed asset.

If the laptop costs less than the threshold, it’s usually expensed immediately and treated as an IT asset but not a fixed asset for accounting purposes.

So, in short: All laptops are IT assets, but only those that meet capitalization rules become fixed assets.

Read also: Best IT Asset Tracking Software in 2025

What Is Fixed Asset Tracking?

Fixed asset tracking is the process of keeping detailed and accurate records of a company’s fixed assets throughout their entire lifecycle. This includes knowing where each asset is located, who is responsible for it, its current condition, and its financial value.

For example, if a company purchases office furniture, fixed asset tracking helps ensure that each chair, desk, and filing cabinet is accounted for. It records when the items were bought, how much they cost, and when they might need repairs or replacement. This level of detail prevents loss, misuse, or forgotten assets.

Tracking fixed assets also involves monitoring important information such as purchase dates, warranties, maintenance history, and depreciation. Keeping these records up to date allows companies to plan budgets accurately and comply with financial reporting requirements.

By maintaining clear visibility over fixed assets, businesses can avoid unnecessary spending, improve operational efficiency, and ensure they meet legal and audit obligations. Essentially, fixed asset tracking helps protect valuable resources and supports smarter decision-making about asset use and replacement.

Why fixed asset tracking is important?

Tracking fixed assets matters because it helps businesses protect and make the most of their valuable resources. Here are some key reasons why fixed asset tracking is essential:

- Preventing Loss and Theft When you know exactly what assets you have and where they are, it’s much harder for items to go missing. Without tracking, laptops, machinery, or vehicles can be lost or stolen without anyone noticing until it’s too late.

- Accurate Financial Records Fixed assets represent significant investments. Tracking them properly ensures that their value is recorded correctly on financial statements. This is important for depreciation calculations, budgeting, and tax reporting.

- Simplifying Audits and Compliance Regulations and accounting standards require businesses to keep accurate records of their assets. Fixed asset tracking makes audits smoother and helps avoid penalties or legal issues.

- Optimizing Maintenance and Usage Knowing the condition and usage history of assets allows companies to schedule maintenance before problems occur. This reduces downtime and extends the useful life of expensive equipment.

- Better Budgeting and Planning With clear data on when assets were bought and their expected lifespan, businesses can plan replacements and upgrades more effectively. This helps avoid unexpected costs and supports strategic decision-making.

How It’s Done: Methods of Tracking?

Here are the common methods companies use to track their fixed assets:

Manual Tracking

Manual tracking is the most basic way to keep track of fixed assets. It usually involves using spreadsheets, paper logs, or simple databases to record information like asset names, purchase dates, locations, and who is responsible for each item.

For example, a small business might list all their office furniture and equipment in an Excel sheet, updating it whenever something is bought, moved, or disposed of.

While manual tracking is low-cost and easy to start, it can become difficult to manage as the number of assets grows. It also increases the chance of errors or missed updates since everything relies on people remembering to record changes.

Despite its limitations, manual tracking can still work well for very small companies or organizations with only a few fixed assets.

Barcode and QR Code Scanning

Barcode and QR code scanning is a step up from manual tracking. In this method, each asset gets a unique barcode or QR code label attached to it. When employees want to check or update asset information, they scan the code using a handheld scanner or smartphone.

For example, a company might put QR code stickers on all its computers and use a phone app to quickly scan and record which laptop is assigned to which employee or where it’s located.

This method helps reduce errors since scanning is faster and more accurate than typing data manually. It also speeds up inventory checks and makes it easier to keep asset records up to date.

Barcode and QR code tracking works well for companies of all sizes and can be integrated into asset management software for even better control.

RFID (Radio Frequency Identification)

RFID uses small tags attached to assets that can be read remotely by special scanners. Unlike barcodes or QR codes, which need to be scanned one at a time, RFID tags can be detected from a distance, even if they’re hidden from view.

For example, a warehouse might tag all its machinery with RFID chips. When staff walk through with an RFID reader, the system automatically detects all nearby assets and updates their locations instantly.

This method is much faster for tracking large numbers of assets, especially across multiple rooms or sites. It also reduces the chance of human error and can improve security by quickly identifying missing or moved items.

Because RFID systems require special equipment, they tend to be more expensive but offer great efficiency for companies managing many assets.

Fixed Asset Management Software

Fixed asset management software is a specialized tool designed to make tracking and managing assets easier and more efficient. Instead of manually entering data or scanning codes one by one, this software centralizes all asset information in one place.

For example, a company using this software can track laptops, vehicles, and machinery all through a single dashboard. The software can automatically calculate depreciation, remind staff about upcoming maintenance, and generate reports for audits or budgeting.

Many modern solutions are cloud-based, which means teams can access real-time asset data from anywhere using a computer or smartphone. This makes it easier to keep records up to date and improves collaboration across departments.

Using fixed asset management software reduces errors, saves time, and provides a clear overview of a company’s valuable resources, helping businesses make smarter decisions about their assets.

Integration with Other Systems

Integration means connecting fixed asset tracking with other business software like accounting, ERP (Enterprise Resource Planning), or inventory systems. This creates a seamless flow of information between different departments.

For example, when a new laptop is purchased and recorded in the asset tracking system, the purchase details automatically update the accounting software. This keeps financial records accurate without needing to enter the same data twice.

Integration helps companies save time, reduce errors, and get a complete view of their assets and finances in one place. It also makes reporting and compliance easier by keeping all relevant data connected and up to date.

By linking asset tracking with other systems, businesses improve efficiency and make smarter decisions based on accurate, real-time information.

What Good Fixed Asset Tracking Looks Like?

Good fixed asset tracking means having a reliable system that keeps all asset information accurate and up to date. This includes details like purchase dates, locations, costs, and maintenance records. When asset data is organized and regularly updated, teams can quickly access the information they need for budgeting, audits, or daily operations.

A strong tracking system also helps businesses manage the financial side of assets well. It ensures depreciation is calculated correctly and asset values are properly reflected in accounting records. This supports compliance with accounting rules and helps plan for future expenses like repairs or replacements.

Finally, good asset tracking creates clear accountability by showing who is responsible for each item. It also sends timely alerts for maintenance or when assets reach the end of their useful life. This reduces loss, prevents unexpected breakdowns, and makes audits smoother and less stressful.

If you’re looking for a tool to help with fixed asset tracking—especially for IT assets like laptops, servers, and software—you can try AssetLoom. AssetLoom focuses on IT Asset Management (ITAM), making it easier to track, manage, and optimize your technology assets.

While AssetLoom is designed mainly for IT assets, it offers features that help with overall asset visibility and control, which can support broader fixed asset tracking needs. It’s a great option if your company relies heavily on IT equipment and wants a modern, efficient way to keep everything organized.

Conclusion

Fixed asset tracking plays a vital role in helping businesses manage their valuable resources efficiently. By keeping accurate, up-to-date records and using the right tools, companies can save time, reduce errors, and protect their investments. Whether you’re tracking office furniture, machinery, or IT equipment, a good system makes a real difference.

Choosing the right tracking method depends on your company’s size, budget, and needs. From simple spreadsheets to advanced software like AssetLoom, there are plenty of options to help you stay organized and in control.

Related Blogs

Subscribe for Expert Tips and Updates

Receive the latest news from AssetLoom, right in your inbox.