What is Equipment Loan Management Software? Key Features of An Ideal Software

Equipment loan management software provides the ability to track where the equipment is, who is using it, when it’s due for return.

Managing equipment can be a complex and time-consuming task, especially for businesses, organizations, and institutions that rely on various tools and machinery for daily operations. From managing inventory to tracking usage, maintenance, and returns, the process can quickly become overwhelming. This is where Equipment Loan Management Software comes into play.

In this article, we’ll explore what equipment loan management software is, how it works, and the key features you should look for when selecting a system for your organization. By the end of this guide, you’ll have a clear understanding of how such software can benefit your business, reduce operational inefficiencies, and improve overall asset management.

What is Equipment Loan Management Software?

At its core, equipment loan management software is a digital tool designed to help businesses and organizations manage their equipment and assets that are loaned out to employees, customers, or other departments. The software helps to keep track of where the equipment is, who is using it, when it’s due for return, and whether any maintenance is required.

This software solution is especially useful for industries that rely on expensive or specialized equipment, such as construction, healthcare, IT, and education. It helps streamline the process of loaning and tracking equipment, ensuring that resources are being used efficiently and that assets are protected from misuse or damage.

Equipment loan management systems can be used by both internal teams (like HR or facilities management) and external customers who borrow equipment. They typically come with a range of features that help track key information such as the equipment’s condition, the borrower’s details, usage history, and return deadlines.

Read more: Optimizing Medical Equipment with Equipment Management Software

The Importance of Equipment Loan Management Software

Equipment loan management systems have become essential tools for many industries for several reasons:

1. Efficiency:

Managing equipment manually using spreadsheets or paper logs is not only time-consuming but prone to human error. With equipment loan management software, the entire process can be automated and streamlined, reducing the need for manual tracking.

2. Asset Security:

Proper equipment tracking ensures that the equipment is well-managed and not misplaced or damaged. If the equipment is loaned out, the system can send reminders to the borrower about due dates or maintenance requirements, which minimizes the risk of loss or misuse.

3. Cost Savings:

By maintaining an organized inventory and ensuring that equipment is properly tracked, companies can avoid purchasing unnecessary replacements for lost or broken equipment. This reduces costs and optimizes the use of the equipment already owned by the company.

4. Data Insight:

Equipment loan management software provides insightful reports and analytics about equipment usage, performance, and trends. This data can be invaluable for decision-making, budgeting, and long-term planning.

Key Features of Equipment Loan Management Software

When selecting equipment loan management software, there are several key features that should be considered. These features ensure that the software can meet the needs of your business and help you manage your equipment effectively.

1. Inventory Management

A core feature of any equipment loan management software is inventory management. This feature allows businesses to track all of their assets in a central location. Users can add details about each piece of equipment, such as the name, model, serial number, purchase date, condition, and location. Having this information readily available helps ensure that all equipment is accounted for and easily retrievable.

The inventory management feature also enables businesses to categorize equipment based on type, department, or other relevant criteria. This makes it easier to manage large inventories and quickly locate specific items when needed.

2. Loan Tracking and Scheduling

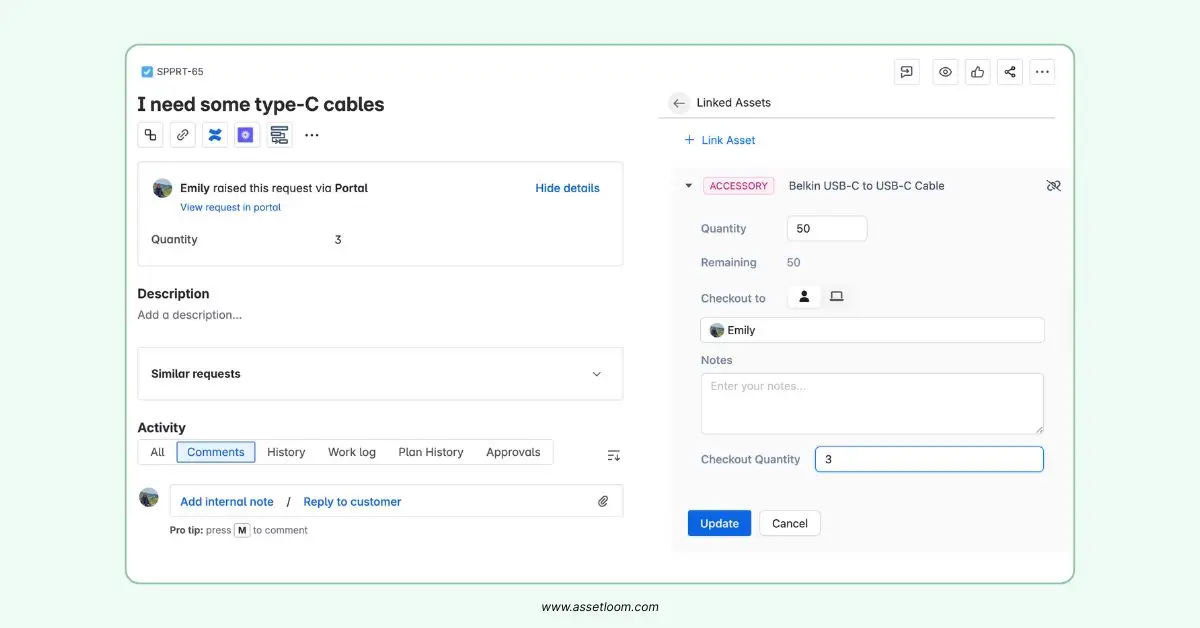

Loan tracking is one of the most important functions of equipment loan management software. The system should allow users to check out equipment to borrowers, whether employees or external clients. This feature tracks which equipment has been borrowed, by whom, and for how long.

Equipment Booking and Loan Management in AssetLoom

Loan scheduling is equally important. The software should include a calendar or scheduling tool that allows users to set loan dates, return deadlines, and reminders. This helps prevent delays and ensures that the equipment is returned on time.

3. Automated Alerts and Notifications

Automated notifications are a crucial feature for ensuring that equipment is returned on time and in good condition. When a loan period is coming to an end, the software can automatically send reminders to the borrower about the return date. If a borrower fails to return the equipment on time, the system can send additional alerts to both the borrower and the equipment manager.

Some systems also include alerts for maintenance and inspections. For example, if a piece of equipment is due for maintenance, the software can send an automatic notification to the responsible team member to schedule a repair or service. This helps ensure that all equipment is maintained and operational.

4. Condition Tracking and Maintenance Management

In addition to loan tracking, equipment loan management software should also track the condition of each asset. This feature helps companies monitor whether equipment is in good working order or if it requires repair. Regular maintenance schedules can be created and tracked within the software.

When equipment is returned, the system can prompt the borrower to indicate its condition. This helps equipment managers keep tabs on any wear and tear, allowing them to perform timely repairs or replace items that are no longer functional.

5. Reporting and Analytics

Reporting and analytics are essential for gaining insight into how equipment is being used and how well it is being managed. They could be an asset dashboard, a comprehensive real-time report, etc. Equipment loan management software should provide detailed reports on various metrics, such as:

- Usage history

- Loan duration

- Maintenance and repair costs

- Return and overdue rates

- Asset depreciation

These reports can help managers make data-driven decisions regarding equipment purchases, maintenance schedules, and resource allocation. Additionally, this data can be used for budgeting and forecasting purposes.

6. User Access and Permissions

Most equipment loan management software provides user access control, which is important for managing who can borrow, approve, or view equipment records. For example, you may want to restrict access to certain pieces of equipment to only certain employees or departments. User permissions help maintain order and prevent unauthorized access to valuable assets.

By setting roles and permissions, administrators can control who is allowed to make changes to the system, ensuring that only authorized individuals can approve loans or modify equipment records.

7. Barcode and QR Code Generation

Barcode and QR code generation is a convenient feature that can enhance the speed and accuracy of inventory management. When equipment is checked in or checked out, a barcode or QR code can be scanned, making the process faster and more accurate. This eliminates the need for manual data entry and reduces the likelihood of errors.

Related article: Using QR Codes or Traditional Asset Tags: What’s Best for Inventory Accuracy?

This feature is especially useful in environments where equipment is frequently moved or checked out to different locations. Scanning barcodes or QR codes also makes it easier to track equipment in real-time.

8. Cloud-Based Accessibility

Cloud-based software offers the benefit of remote access, which is particularly useful for businesses with multiple locations or remote workers. Cloud-based equipment loan management software allows administrators and users to access the system from anywhere, at any time, as long as they have an internet connection.

This feature provides flexibility and ensures that equipment management is not restricted by physical location. It also simplifies data backup and recovery, as cloud systems typically include automatic backup features.

9. Integration with Other Systems

Many businesses use multiple software tools to manage different aspects of their operations. For example, a company might use an enterprise resource planning (ERP) system to handle accounting or human resources software to manage employee information.

AssetLoom integrates with Jira Service Management

To streamline operations, it’s important for equipment loan management software to integrate seamlessly with other software systems. This integration reduces duplication of work, ensures consistency across systems, and helps centralize data for easier reporting.

10. Customizable Features

Every business has its own unique equipment management needs. Therefore, it’s important to choose equipment loan management software that can be customized to fit those needs. Customizable features might include the ability to add fields to the equipment record, adjust loan duration policies, or set up specific workflows for equipment approval.

Having the flexibility to customize the system ensures that it works for your business’s specific processes and requirements.

Conclusion

Equipment loan management software is a powerful tool that can help businesses and organizations streamline the process of loaning and managing equipment. With features like inventory management, loan tracking, automated alerts, and maintenance management, the software makes it easier to keep track of valuable assets, reduce errors, and improve efficiency. By selecting a system with the right features for your business, you can enhance asset security, minimize downtime, and make better data-driven decisions.

When choosing an equipment loan management solution, consider the size and complexity of your operations, the types of equipment you manage, and the specific needs of your business. With the right software in place, you can ensure that your equipment is used effectively and that your company’s resources are being managed in the best way possible.

Subscribe for Expert Tips and Updates

Receive the latest news from AssetLoom. right in your inbox