Using Cloud Asset Tracking to Catch Ghost Assets Early

Cloud Asset Tracking helps businesses identify and eliminate ghost assets, improving asset management, reducing costs, and enhancing security.

Ghost assets are a hidden problem in many IT environments. These are devices, licenses, or other resources that are no longer in use but still appear in inventory records. Over time, they can distort reports, inflate budgets, and create compliance issues.

This often happens when tracking relies on spreadsheets, manual updates, or disconnected systems. Data becomes outdated quickly, and missing assets go unnoticed.

Cloud asset tracking and Cloud asset management offer a more reliable way to manage this. It keeps asset records updated automatically by connecting to usage data, network activity, and system logs. This helps IT teams spot ghost assets early and take corrective action based on accurate information.

What Are Ghost Assets?

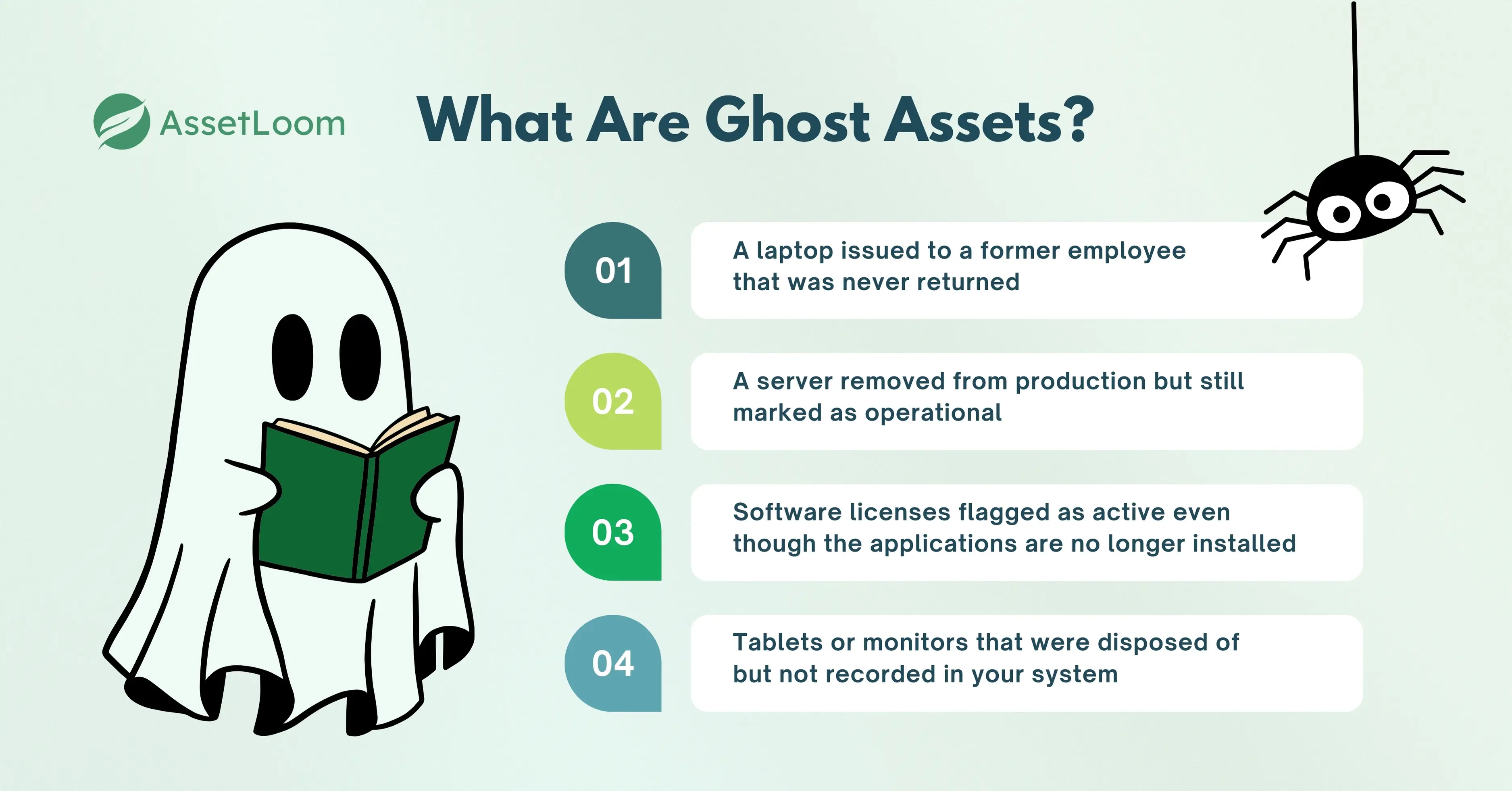

A ghost asset is an item listed in your IT inventory that no longer exists, is unusable, or cannot be located. It might be marked as active, assigned, or in service, but in reality, it is gone, broken, retired, or lost.

This includes:

- A laptop issued to a former employee that was never returned

- A server removed from production but still marked as operational

- Software licenses flagged as active even though the applications are no longer installed

- Tablets or monitors that were disposed of but not recorded in your system

These assets remain in databases, spreadsheets, or asset tools as if they are still in use. They inflate asset counts, distort reports, and often trigger unnecessary spending on support contracts, license renewals, or insurance.

Several factors lead to ghost assets:

- Inventory systems that are not updated when assets are moved or retired

- Manual tracking that depends on spreadsheets or informal updates

- Poor recovery processes during employee offboarding

- Asset data stored in isolated tools that never sync

- Infrequent audits, allowing outdated entries to remain undetected

Ghost assets are not just clerical errors. They reflect deeper visibility problems and can quietly affect decisions if left unchecked.

The Real Cost of Ghost Assets

Ghost assets may seem like a small issue, but they can add up in significant ways over time. Their impact stretches beyond simple inaccuracies in inventory. They can affect your bottom line, operational efficiency, and compliance standing.

1. Financial Losses

You are essentially paying for assets that do not exist or are no longer in use. This could mean:

- Paying for software licenses that are not being used

- Renewing maintenance contracts for devices that have been decommissioned

- Insuring assets that are no longer in service

- Overspending on equipment replacements because inventory data is inaccurate

These ongoing costs build up, leading to unnecessary expenditures that could be better allocated elsewhere.

2. Operational Inefficiencies

Ghost assets mislead IT teams about resource availability. For example:

- Capacity Planning: If a server is listed as operational but is actually retired, your planning for server capacity may be inaccurate. This can lead to over- or under-purchasing of equipment.

- Asset Allocation: Employees may be assigned assets that are not available or no longer in working condition, leading to downtime and confusion.

These inefficiencies can delay projects, reduce productivity, and impact team performance.

3. Compliance and Audit Risks

Many industries require accurate asset tracking for regulatory compliance. Ghost assets can cause issues during audits:

- Audit Discrepancies: If asset records show a larger inventory than what is physically present, it can raise red flags during audits. This could result in fines or reputational damage.

- Security Gaps: Ghost assets, especially outdated or retired hardware, may still have access to your network. If they are not properly decommissioned, they could pose security risks.

These risks can lead to legal and financial consequences if not addressed.

How Cloud Asset Tracking Helps Identify Ghost Assets

Cloud asset tracking involves using online tools to monitor all your resources in real time. By providing accurate, up-to-date information, it helps identify and eliminate ghost assets early. Here is how it works:

![]()

1. Centralizing Data

With cloud asset tracking, all asset data is stored in a single, unified system. This centralization makes it easier for teams across different departments and locations to view the same list of assets, ensuring everyone is on the same page. When all updates, such as asset movements or retirements, are tracked in one place, discrepancies like ghost assets become more visible.

For example, if an asset is marked as "in use" but no one in the team can locate it or confirm its status, the centralized database immediately flags this discrepancy, allowing it to be addressed before it escalates.

2. Tagging Assets

Using technologies like barcodes, QR codes, or RFID tags, cloud asset tracking systems can track each asset’s location and status. This method adds another layer of visibility, making it easier to identify assets that have been idle or misplaced.

When assets are tagged, they can be scanned to check their activity and movement in real time. For example, if a laptop has been assigned to an employee but is never scanned or updated in the system after it is issued, it is flagged as idle or potentially a ghost asset, prompting a check-in or audit.

3. Automating Updates

One of the biggest challenges with manual tracking systems is the lag between changes in asset status and their reflection in inventory records. Cloud asset tracking eliminates this problem by automating updates.

When an asset is decommissioned, transferred, or disposed of, these changes are recorded immediately in the cloud system. This ensures that your asset inventory is always current. The automated nature of the updates reduces the chance of errors or overlooked assets that could become ghost assets over time.

For instance, if an asset is no longer being used and is removed from the network, the system updates its status in real time, removing it from the active asset list. If this step is missed, the asset could remain "on the books" even though it is no longer in service.

4. Regular Audits

Regularly auditing your asset list against physical items is crucial for catching ghost assets. Cloud asset tracking systems make this process more efficient by offering detailed reports that can be compared with physical inventory.

Audits can be scheduled automatically, with reminders set to ensure they happen on time. During an audit, assets that do not match the records, such as those missing from the physical location or marked as unused, are flagged. These discrepancies can be investigated, ensuring ghost assets are caught early and preventing them from affecting your financials or compliance standing.

Case Studies and Examples

While specific case studies on cloud asset tracking solutions may be limited in the sources, several practical examples highlight the tangible benefits and the significant impact of managing ghost assets effectively.

- ezo.io references a Gartner case where an enterprise saved $100,000 by identifying and eliminating a rarely used product in their asset inventory. This example demonstrates the clear financial benefits of having an effective asset management system in place. By identifying underutilized or ghost assets, companies can reduce unnecessary costs and focus on optimizing their resources.

- Innovapptive points out that 12-25% of assets in fixed asset ledgers are ghost assets. This statistic underscores the scale of the problem and the urgent need for automated tracking systems to address it. By using automated tracking, organizations can avoid the inefficiencies caused by ghost assets, ensuring accurate and up-to-date records.

- JupiterOne reports that organizations using their cloud asset tracking solution have been able to decommission ghost assets, avoiding nearly $2.4 million in security risks and balance sheet inefficiencies. This highlights the cybersecurity and financial risks associated with ghost assets. When ghost assets are not properly tracked, they can pose a security threat, especially if they are outdated or not fully decommissioned. By effectively managing these assets, businesses can reduce potential vulnerabilities and improve their overall security posture.

Conclusion

Using cloud asset tracking to catch ghost assets early is a proactive strategy that leverages centralized, real-time, and automated systems to mitigate risks and optimize resources. By implementing tools like AssetLoom, and following best practices, organizations can reduce costs, enhance security, ensure compliance, and improve operational efficiency.

Related Blogs

Subscribe for Expert Tips and Updates

Receive the latest news from AssetLoom, right in your inbox.