How to Calculate Total Cost of Ownership (TCO)?

Total Cost of Ownership helps you understand the full cost of IT assets over time. Learn how to calculate TCO, what factors to include, and how to make smarter purchasing decisions.

IT budgets are tight, and teams are under pressure to do more with less. It’s easy to focus only on the sticker price when buying new hardware or software. But over time, many organizations find themselves spending far more than they expected.

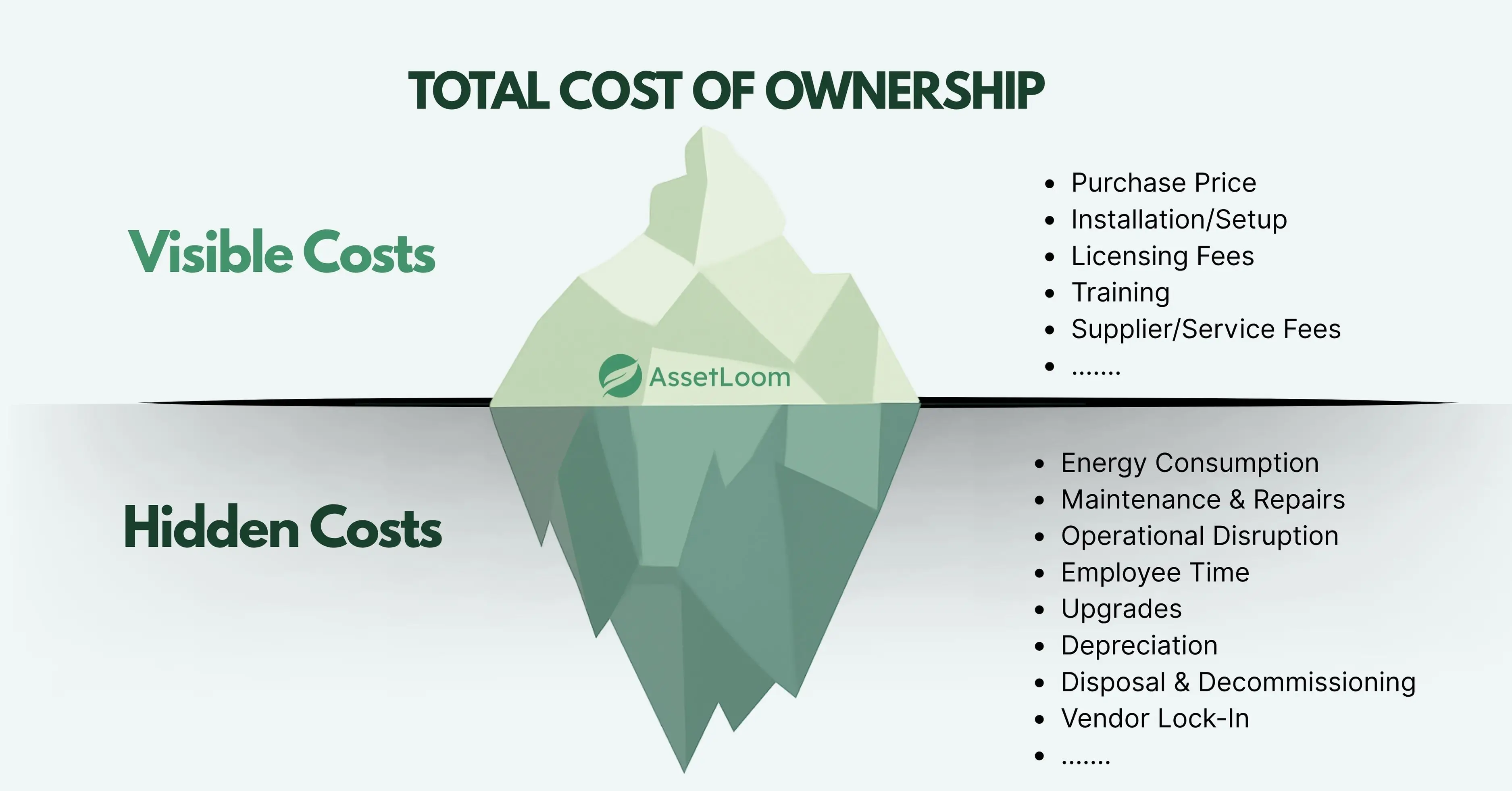

This is a common challenge in IT asset management. The real cost of owning technology isn’t just the upfront price. There are ongoing costs like maintenance, support, energy use, downtime, and eventual disposal. These hidden costs can quietly drain resources and impact your bottom line.

That’s where the concept of Total Cost of Ownership (TCO) comes in. TCO gives you a clearer view of what an asset costs from the day you acquire it until it’s no longer in use.

What Is Total Cost of Ownership?

When you buy a new piece of technology, it’s easy to focus on the price tag. But the truth is, that number usually represents just a small slice of what you’ll actually spend over the life of the asset.

Total Cost of Ownership (TCO) is a way to estimate all the costs involved in owning and using something, not just the upfront price. It includes everything from deployment and setup, to ongoing maintenance, energy use, support, upgrades, and finally, retirement or disposal.

Think of TCO as the full story behind a purchase. It helps you understand what that server, laptop, or cloud subscription will really cost over three, five, or even ten years. In some cases, operating costs can far exceed the original purchase amount.

That’s why relying only on the initial price can lead to decisions that cost more in the long run. TCO gives you a better way to compare options and make smarter investments by showing the true, long-term cost of ownership.

What factors determine TCO?

The Total Cost of Ownership includes more than just what you pay up front. It covers all costs tied to owning and operating an asset from the moment you buy it to the day it’s retired ( IT Asset lifecycle Management). These costs fall into three main categories: direct, indirect, and sometimes even intangible.

Here’s a closer look:

1. Direct Costs

Direct costs are the most visible and easiest to calculate when evaluating Total Cost of Ownership. These are the upfront and predictable expenses that come directly from purchasing and setting up the asset.

Here are some common examples:

- Purchase Price: This includes the initial cost of the hardware, software, or service. It might be a one-time payment or a subscription fee, depending on the product.

- Installation and Setup: Getting the asset up and running often involves additional costs, such as configuration, deployment services, or third-party installation support.

- Hardware and Software Licensing: For many IT assets, you’ll need to purchase software licenses or pay for access to features. Some tools also require device-specific licenses or user-based pricing.

- Maintenance Contracts: Manufacturers or vendors may offer service agreements or extended warranties. These usually cover repairs, updates, or replacement parts.

- Upgrades and Add-ons: As your needs grow, you may need to purchase additional storage, memory, modules, or features that weren’t part of the base product.

These costs are usually straightforward, but it’s important to record all of them clearly at the start. Overlooking just one setup or licensing fee can throw off your TCO calculation early on.

2. Indirect Costs

These costs aren’t always visible at first, but can significantly impact your total over time. They often show up during day-to-day use, support, and system management.

Here are some common examples:

- Training: New hardware or software often requires training for staff. This could be formal sessions, self-paced learning, or even the time your team spends getting comfortable with new tools.

- Downtime: If a system goes down or needs maintenance, the disruption can lead to lost productivity or delayed work. Even small outages add up over time.

- Performance Inefficiencies: Slower or poorly performing systems can waste time. Whether it’s lagging load times or regular glitches, these issues reduce efficiency and frustrate users.

- Ongoing IT Labor: IT teams spend time managing updates, troubleshooting, monitoring, and providing support. This labor carries a cost, even if it's handled in-house.

- Integration Work: New assets may need to connect with existing systems or workflows. This can involve additional software, custom development, or hiring external help.

These costs are often overlooked but play a big role in the true cost of ownership. Including them gives a clearer picture of how much value or strain an asset brings over time.

3. Intangible Costs

Intangible costs are harder to measure in dollars but still affect the total value and performance of an asset. These are often linked to user experience, risk, or long-term impact.

Here are some common examples:

- Productivity Loss: If a system is difficult to use, unreliable, or causes delays, employees may waste time or work less efficiently, even if it’s not obvious right away.

- Compliance and Security Risks: An asset that doesn’t meet regulatory requirements or has weak security controls can expose your organization to fines, audits, or breaches.

- Vendor Lock-In: Some tools make it difficult or expensive to switch providers later. This lack of flexibility can limit future choices and drive up long-term costs.

- Reputation Impact: Inconsistent performance or downtime can hurt customer satisfaction or team trust, especially if the asset supports a critical service.

- Sustainability Requirements: As environmental regulations and internal goals evolve, assets that use more energy or generate more waste may lead to extra reporting work or long-term replacement costs.

While intangible costs can be tough to quantify, they often influence long-term satisfaction and return on investment. It’s worth considering them in any TCO analysis.

New Considerations in TCO

Modern IT environments add even more to think about:

- Cloud and SaaS fees: Pay-as-you-go services often include hidden costs like data storage, API calls, or data transfer fees (also known as cloud egress charges).

- AI-powered tools: Predictive analytics can forecast future costs, optimize performance, or help plan upgrades but they come with licensing or infrastructure requirements.

- Green IT and sustainability: Energy-efficient systems may cost more upfront but lower electricity bills over time. Plus, organizations are increasingly tracking the environmental impact of their technology.

When calculating TCO, the goal is to capture everything from purchase to retirement. That includes any cost that touches the asset throughout its life, even the less obvious ones.

How is Total Cost of Ownership Calculated? Try the TCO FORMULA

Calculating TCO means thinking beyond just the price tag. It’s about adding up everything you’ll spend or lose over the entire life of the asset, and subtracting any value you might recover at the end.

There’s no one-size-fits-all formula, but here’s a flexible structure you can start with:

TCO = I + O + M + D – R

Where:

- I = Initial cost (purchase, setup)

- O = Operating cost (day-to-day use)

- M = Maintenance and support

- D = Downtime or loss from inefficiencies

- R = Remaining or resale value

Let’s go into more detail:

Initial Cost (I)

This includes:

- Hardware or software purchase

- Installation, delivery, and configuration

- One-time fees (e.g., licensing, activation)

Even though this is the most visible cost, it’s often a small part of the full TCO.

Operating Cost (O)

These are recurring costs tied to using the asset:

- Energy or cooling (especially in data centers)

- Subscription renewals

- User licenses or API calls (for SaaS products)

- Insurance and compliance monitoring

Some assets, like printers or servers, may appear low-cost until you factor in expensive ongoing usage fees.

Maintenance and Support (M)

Keeping your asset running includes:

- Scheduled maintenance (cleaning, patching, monitoring)

- Unexpected repairs or part replacements

- Vendor support contracts

- Internal labor hours spent managing the asset

Older assets often cost more to maintain than newer ones.

Downtime and Disruption (D)

This is one of the most underestimated costs:

- Time lost during outages or slow performance

- Work delays or missed deadlines

- Lost revenue or customer satisfaction

- Cost of emergency fixes

Even brief system downtime can be costly, especially for critical business operations.

Remaining Value (R)

At the end of its useful life, the asset might still have:

- Resale or trade-in value

- Useful parts that can be reused

- Tax or depreciation benefits

Subtracting this value helps you reflect only what the asset costs your organization over time.

Let’s Look at a Simple TCO Example

The full TCO formula can feel a bit overwhelming, so let’s start with a simple version using just three key variables:

TCO = I + M – R Where:

- I is the Initial cost

- M is the Maintenance cost

- R is the Remaining value after a few years

Let’s compare two laptops: Laptop A and Laptop B. We’ll look at their costs over 3 years.

| Laptop A | Laptop B | |

|---|---|---|

| Initial cost (I) | $1,000 | $1,800 |

| + Maintenance (M) | $600 | $300 |

| – Remaining value (R) | $100 | $500 |

| **= TCO** | $1,500 | $1,600 |

At first glance, Laptop A looks cheaper by $100. Based on just these three factors, it might seem like the better option.

Now Let’s Add Downtime to the Formula

If we add a fourth factor—downtime—we start to see a different picture. Downtime can include slow performance, crashes, or time spent on tech support. Here’s the extended formula:

TCO = I + M + D – R

Where:

- D is the cost of Downtime (lost time, delays, or extra labor)

Let’s assume Laptop A has regular issues that cost about $2,000 in lost time over 3 years. Laptop B only has minor delays worth $400.

| Laptop A | Laptop B | |

|---|---|---|

| Initial cost (I) | $1,000 | $1,800 |

| + Maintenance (M) | $600 | $300 |

| + Downtime (D) | $2,000 | $400 |

| – Remaining value (R) | $100 | $500 |

| = TCO | $3,500 | $2,000 |

Now, Laptop B clearly comes out ahead. Even though it had a higher upfront cost, the lower downtime and better resale value make it much more cost-effective over time.

What This Tells Us

The more factors you include in your TCO calculation, the clearer your comparison becomes. A product that looks cheaper at first might cost a lot more in the long run. That’s why a full TCO analysis is so valuable; it helps you make smarter decisions that go beyond the price tag.

The challenges in calculating TCO

There are many ways to calculate Total Cost of Ownership, and several tools and templates exist to help with the process. But even with these resources, TCO calculations are far from perfect. One common challenge is the lack of a consistent method across teams or departments. Without a shared approach, it's difficult to compare options or make decisions based on consistent data.

Another issue is defining the full scope of operating costs. Some expenses, like electricity or labor hours, are hard to track and often spread across different budgets. Others, such as depreciation, insurance, or warranty coverage, may be included for one asset but not another, making comparisons inaccurate.

For example, one piece of equipment might have higher support costs because spare parts are included in the contract. At first glance, that looks more expensive than a cheaper support plan, but it might actually reduce long-term spending by avoiding separate replacement purchases. Without digging into the details, those tradeoffs can be missed.

TCO estimates also struggle to account for rising costs or unexpected changes. If the price of replacement parts spikes or a software vendor raises subscription fees, your original calculations may no longer reflect reality. These fluctuations are hard to predict but can have a major impact on the total cost.

Another complication is vendor dependency. If a vendor discontinues a product, removes features, or ends support earlier than expected, you may face new upgrade or migration costs that were never part of the original plan. These shifts are rarely included in early-stage TCO calculations but can be some of the most expensive surprises down the road.

Lastly, some costs like reduced productivity, user frustration, or compliance risks are real but difficult to assign a dollar value. That makes them easy to overlook or underestimate, even though they may affect performance or budget outcomes just as much as direct costs.

Despite these challenges, TCO remains a useful way to plan smarter and look beyond upfront costs. Even if your first calculation isn’t perfect, it’s a valuable starting point for better long-term thinking.

TCO in cloud vs. on-premises IT infrastructure

When deciding between cloud and on-premises infrastructure, it’s not just about features—it’s also about cost over time. Both options come with different types of expenses that affect their Total Cost of Ownership (TCO). Here's a side-by-side comparison of common cost factors.

| Factor | Cloud (SaaS, IaaS, PaaS) | On-Premises (Servers, Data Centers) |

|---|---|---|

| Upfront cost | Low (subscription-based) | High (capital expense for hardware/setup) |

| Maintenance cost | Handled by the provider | Requires in-house IT resources |

| Scalability | High (scale up or down as needed) | Limited and slower to adjust |

| Energy cost | Included in service fees | Paid separately (power, cooling, etc.) |

| Vendor lock-in | Higher risk | Lower risk, more control |

| Long-term TCO | Variable and usage-based | More predictable and stable |

Key Takeaways:

- Cloud is flexible and low-cost to start but can become expensive as usage grows or needs change. Costs like data transfer, storage, and support may increase over time.

- On-premises requires a larger upfront investment and ongoing maintenance, but gives you more control over costs and infrastructure.

The best choice depends on your organization’s goals, technical resources, and how predictable your usage patterns are. TCO helps you evaluate both options with a long-term perspective, not just the short-term price tag.

Best practices to optimize TCO calculations

A well-done TCO analysis helps you look past the upfront cost and understand what an asset truly costs over time. Whether you're managing IT equipment, cloud services, or hybrid environments, these best practices can help improve the accuracy and usefulness of your TCO calculations.

- Use a Standardized TCO Framework: Start with a consistent approach. Using a recognized model like Gartner’s TCO framework for IT infrastructure or ISO 15686-5 for lifecycle cost analysis helps ensure all factors are covered and that comparisons are fair and repeatable across your organization.

- Include Environmental and Sustainability Costs: TCO isn’t just about dollars—it’s also about impact. More organizations are tracking carbon emissions, power usage, and environmental impact from their IT infrastructure. Choosing energy-efficient hardware or low-carbon cloud providers can lower operational costs and support sustainability goals.

- Consider the Real Cost of Vendor Lock-In: Switching providers down the road can be expensive. Before committing to a vendor, factor in migration, training, contract limitations, and data transfer restrictions. Proprietary tools may offer convenience now, but they can limit your flexibility later.

- Leverage AI and Predictive Analytics: AI-powered tools can analyze past spending and predict future costs, helping you build more accurate TCO forecasts. For cloud environments, platforms like Apptio or Cloudability help track usage, identify waste, and optimize cost over time.

- Involve All Stakeholders: IT may lead the TCO calculation, but finance, procurement, and operations often hold important cost data. Bringing everyone to the table ensures no key expenses are missed, especially indirect and hidden ones.

- Update Regularly: TCO isn’t a one-time exercise. Revisit your models when vendor prices change, assets age, or usage patterns shift. A yearly review helps you keep your numbers realistic and useful for planning.

- Account for Intangibles Where Possible: Even if some costs, like employee frustration or time spent troubleshooting, are hard to quantify, they still impact productivity and ROI. Try assigning rough estimates or using benchmarks to include them in the analysis.

TCO is not just a financial calculation. It’s a decision-making tool that helps you look at the full picture. By applying these practices, you can make more informed, long-term choices that align with both budget and strategy.

Conclusion

Understanding Total Cost of Ownership helps you move beyond surface-level pricing and make smarter, long-term decisions. It gives you a complete view of what an asset will cost, from purchase to retirement, so you can plan more accurately and avoid unexpected expenses.

While TCO calculations can be challenging, even a basic estimate is better than guessing. By considering direct, indirect, and intangible costs and updating your analysis over time, you will be better equipped to compare options, justify investments, and manage your IT assets more effectively.

Summary Checklist: Key Steps to Calculate TCO

- Define the asset or service you are evaluating

- Use a consistent TCO formula (for example: I + M + D – R)

- List all direct costs (purchase, licensing, setup)

- Identify indirect costs (training, downtime, support)

- Consider intangible or environmental costs if relevant

- Estimate the asset’s useful life and remaining value

- Compare multiple options side by side

- Involve stakeholders across departments

- Use tools or historical data to improve accuracy

- Review and update your TCO model regularly

Related Blogs

Subscribe for Expert Tips and Updates

Receive the latest news from AssetLoom, right in your inbox.