Fixing Inventory Conflicts Between Finance and IT

Fixing inventory conflicts between Finance and IT isn’t just about solving problems; it’s about creating a smoother, more efficient process for managing assets.

Inventory isn’t just stuff. It’s strategy. And when Finance and IT teams aren’t on the same page, inventory problems can create ripples that affect everything from cash flow to customer satisfaction.

The challenge isn’t always a lack of effort. It’s often a gap in understanding between departments. Finance needs precise, up-to-date numbers for reporting, while IT is focused on keeping systems running smoothly and securely. When their perspectives clash, inventory discrepancies can arise, causing confusion and inefficiencies.

In this blog, we’ll explore why these conflicts occur, what each team really needs, and how better communication and the right tools, like IT Asset Management (ITAM) systems, can bridge the gap. By the end, you'll have clear, actionable strategies to help Finance and IT collaborate more effectively and resolve inventory conflicts quickly. Let’s dive in!

Why the Conflict Between Finance and IT Happens

Understanding why Finance and IT teams clash over inventory is the first step in fixing the problem. Their objectives, priorities, and ways of working are often quite different. Let’s break down the most common reasons for these conflicts.

1. Different Objectives, Different Priorities

Finance and IT are both concerned with inventory, but they look at it through different lenses.

- Finance cares about numbers. Their goal is to have accurate, up-to-date records that reflect the true value of assets. This means ensuring everything is accounted for properly, making sure the inventory aligns with financial reports, and minimizing risk for audits.

- IT cares about systems. They focus on maintaining the technology and infrastructure that tracks inventory. Their goal is to keep everything running smoothly, integrating systems without hiccups, and ensuring data integrity across the board.

For example, Finance might insist that inventory numbers need to be adjusted to reflect depreciation, while IT is more concerned with making sure the real-time tracking system updates without disrupting operations.

2. The Language Barrier

Another big issue is that Finance and IT often speak different languages.

- Finance focuses on clarity and consistency in reports, using terminology that helps them track financial performance (think: cost of goods sold, asset value, depreciation).

- IT, on the other hand, focuses on technical terms like data integrity, system integration, and database structures. The result? A lot of misunderstandings. What IT describes as “data inconsistencies” may seem to Finance like “financial misreporting”; a critical difference in perspective.

When these two worlds collide, it’s easy for confusion to take hold and inventory conflicts to arise.

3. Lack of Communication and Shared Goals

Perhaps the most significant issue is the lack of regular communication and shared goals between Finance and IT. When departments don’t regularly check in with each other, it’s easy for each team to operate in a silo. This can lead to misunderstandings, delays, and, ultimately, discrepancies in inventory data.

For example, IT may be working on a system update, unaware that Finance is waiting on accurate inventory data for end-of-quarter reports. Without regular meetings or aligned goals, both teams may find themselves frustrated by delays or mismatched data.

The Impact of These Conflicts

When Finance and IT aren’t aligned on inventory, the consequences can ripple through the entire business. What starts as a small discrepancy can quickly snowball into larger issues that affect operations, financial reporting, and ultimately, the bottom line.

1. Operational Disruptions

One of the most immediate effects of inventory conflicts is disruption to daily operations. If Finance and IT teams are working from different data sets or using systems that don’t integrate well, mistakes can happen.

- Example: If Finance relies on outdated inventory numbers for purchasing decisions, they might over-order or under-order stock. This could lead to inventory shortages or excess stock that ties up cash flow.

- Result: These issues can cause delays in production, missed sales opportunities, and longer lead times, ultimately affecting the company’s ability to meet customer demands.

2. Risk to Financial Reporting and Compliance

Inaccurate inventory data doesn’t just cause operational headaches—it also creates significant financial risks.

- Example: Incorrect inventory values reported by Finance can lead to faulty financial statements. This may affect quarterly reports, tax filings, and even audit outcomes. If inventory figures aren’t correct, the whole balance sheet can be thrown off.

- Result: This could lead to legal or compliance issues, potential penalties from regulatory bodies, and even damage to the company’s reputation. For businesses that are publicly traded, the stakes are even higher, with potential impacts on stock prices and investor trust.

3. Lost Efficiency and Increased Costs

When Finance and IT are working with conflicting data or inefficient processes, it’s a drain on both time and resources. The back-and-forth communication, problem-solving, and data reconciliation that occurs when systems aren’t aligned can significantly slow down business processes.

- Example: If both teams are manually correcting data discrepancies or double-checking numbers, that’s time they could be spending on more strategic tasks. Not to mention, the longer these discrepancies go unresolved, the more costly they become.

- Result: The business risks wasting both time and money, increasing operational costs, and losing productivity.

Next, we’ll dive into how both teams can start to understand each other’s perspectives and work together more effectively to solve these issues.

How to Fix Inventory Conflicts Between Finance and IT

1. Building Understanding Between Finance and ITHow to Fix Inventory Conflicts Between Finance and IT

The good news is that inventory conflicts between Finance and IT don’t have to be a permanent issue. By building a deeper understanding of each team’s needs and working together more effectively, these conflicts can be resolved. Here’s how to start.

1.1 Understanding Finance’s Needs

First, it’s important to understand what Finance requires from IT when it comes to inventory.

- Accurate Financial Reporting: Finance needs inventory data to be precise and consistent. Any discrepancies between actual and reported inventory can throw off financial reports and create problems during audits.

- Audit Compliance: Finance teams must ensure that inventory is correctly valued and accounted for in accordance with tax regulations and industry standards. A missing or inaccurately reported asset can lead to compliance issues and penalties.

The key here is ensuring that Finance can rely on a clear, accurate, and real-time view of inventory. Establishing consistent inventory categories, rules for valuation, and ensuring the data flows seamlessly into financial reports can help eliminate confusion.

1.2 Understanding IT’s Needs

On the flip side, IT teams have their own concerns about inventory data. Their main focus is keeping systems running smoothly and ensuring that data is accurate and accessible.

- Data Integrity: IT needs to ensure that the data Finance is using is reliable, secure, and up-to-date. If systems are running on outdated data, it can cause errors and discrepancies.

- System Integration: IT teams care about how inventory data is integrated across various systems (ERP, WMS, etc.). If the data isn’t consistent across platforms, both Finance and IT will struggle to reconcile differences.

IT needs to ensure that all systems involved in inventory tracking (such as ERP systems and asset management software like AssetLoom) communicate with each other seamlessly. This means setting up proper integration points and ensuring that all data flows correctly without manual intervention.

1.3 The Importance of Cross-Department Communication

Finally, regular and transparent communication between Finance and IT is crucial. If both teams understand the challenges the other is facing, they are more likely to work together to find solutions.

Schedule regular check-ins between both departments; monthly meetings, joint project teams, or even ad-hoc problem-solving sessions. During these meetings, focus on aligning goals, addressing concerns, and making sure everyone is on the same page. This will help create a shared understanding of priorities and objectives, making collaboration smoother.

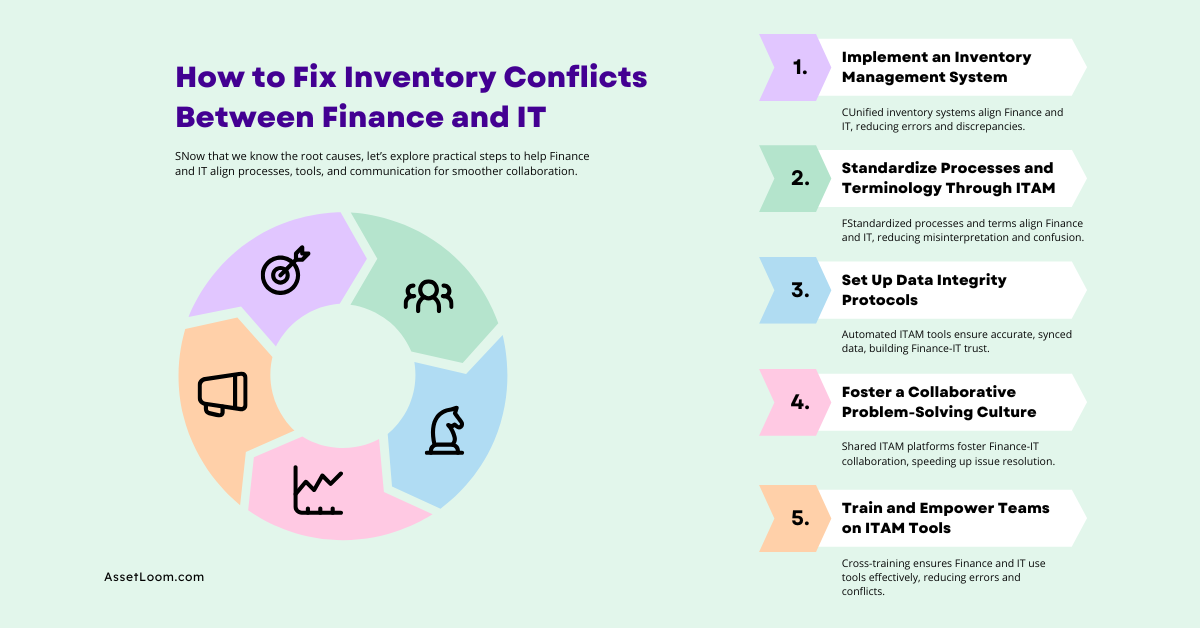

2. Actionable Strategies for Resolving Inventory Conflicts

Now that we understand the root causes of inventory conflicts, let’s explore some practical steps to help Finance and IT teams work together more efficiently. By aligning processes, using the right tools, and maintaining open communication, both teams can overcome these challenges.

2.1: Implement a Unified Inventory Management System with ITAM Tools

One of the most effective ways to eliminate inventory discrepancies is to implement a unified inventory management system that both Finance and IT can use.

- Why ITAM Matters: Asset management tools like AssetLoom provide a centralized platform where both teams can track inventory in real time. This reduces the chances of discrepancies between systems, ensures both teams are working with the same data, and streamlines reporting.

- Benefit: A unified system ensures that all inventory data is consistent, reduces manual errors, and makes cross-departmental collaboration smoother. Both Finance and IT are working from the same data, making it easier to resolve discrepancies quickly.

2.2: Standardize Processes and Terminology Through ITAM

A common source of confusion between Finance and IT is the lack of standardized processes and terminology. Different teams may interpret terms or processes differently, leading to misunderstandings.

- Finance: Define clear inventory valuation rules within the ITAM system. For example, AssetLoom can handle different asset categories and depreciation methods that Finance uses to ensure that inventory values are accurately reflected. IT: Set up standardized protocols for system updates and ensure that all inventory data is captured consistently across all systems. This reduces the chances of conflicting data between Finance’s financial reports and IT’s operational records.

- Benefit: Standardizing terminology and processes ensures that both teams are aligned in their approach to inventory management, reducing confusion and misinterpretation.

2.3: Set Up Data Integrity Protocols with ITAM Integration

Data integrity is critical to maintaining trust between Finance and IT. Both teams need to rely on consistent, accurate data to make decisions.

- How ITAM Helps: Tools like AssetLoom allow teams to automate data synchronization between systems, reducing the risk of human error. Regular data integrity checks can ensure that all systems are updated simultaneously, keeping both teams aligned.

- Benefit: This integration ensures that there are no discrepancies in data, allowing both Finance and IT to rely on the same accurate information, preventing costly errors.

2.4: Foster a Collaborative Problem-Solving Culture with Shared ITAM Insights

Instead of working in silos, Finance and IT should work together to solve problems as a team. This collaborative approach can help resolve discrepancies faster and more effectively.

- ITAM as a Collaboration Tool: AssetLoom can serve as a shared platform where both teams can access the same data and collaborate on resolving issues. When an inventory discrepancy arises, both Finance and IT teams can investigate the root cause together, whether it’s a miscount, data entry error, or system glitch.

- Benefit: A shared platform increases transparency, promotes collaboration, and speeds up the resolution of inventory issues. Instead of finger-pointing, both teams can focus on finding solutions together.

2.5: Train and Empower Teams on ITAM Tools Like AssetLoom

Training is essential to ensure that both Finance and IT understand how to use the tools effectively. The more both teams are familiar with the systems they’re using, the easier it will be to resolve conflicts.

- Finance: Finance teams need to understand how AssetLoom tracks asset lifecycles, depreciation, and valuation. This allows them to leverage the tool for accurate financial reporting.

- IT: IT teams should be well-versed in managing data integrity and system integrations within AssetLoom, ensuring that the system remains reliable and efficient.

- Benefit: When both teams understand the tool and its features, they can use it to its full potential, which will help reduce errors and improve collaboration.

=> Fixing Disconnected Inventory Systems Between Departments

Conclusion

Fixing inventory conflicts between Finance and IT isn’t just about solving problems; it’s about creating a smoother, more efficient process for managing assets. By understanding each other’s priorities, using IT Asset Management (ITAM) tools like AssetLoom, and improving communication, both departments can work together to turn inventory management into a strategic advantage.

The key is for both teams to collaborate: IT ensures systems are running smoothly, while Finance ensures inventory is valued correctly. Tools like AssetLoom help by ensuring real-time data accuracy and fostering collaboration.

By aligning processes, setting clear expectations, and using the right tools, Finance and IT can reduce discrepancies, minimize risks, and improve operations. When both teams work toward the same goal, inventory management becomes a tool for growth, not a source of tension.

Related Blogs

ITAM in General

Fixing Inventory Sync Issues Between ITAM and ITSM Tools

ITAM in General

The Hidden Costs of a Stolen Work Laptop & How to Prevent Them

Subscribe for Expert Tips and Updates

Receive the latest news from AssetLoom. right in your inbox